Question: Please show steps how to calculate so that I will understand. Thank you. Calculating Salvage Value [LO1] An asset used in a four-year project falls

Please show steps how to calculate so that I will understand. Thank you.

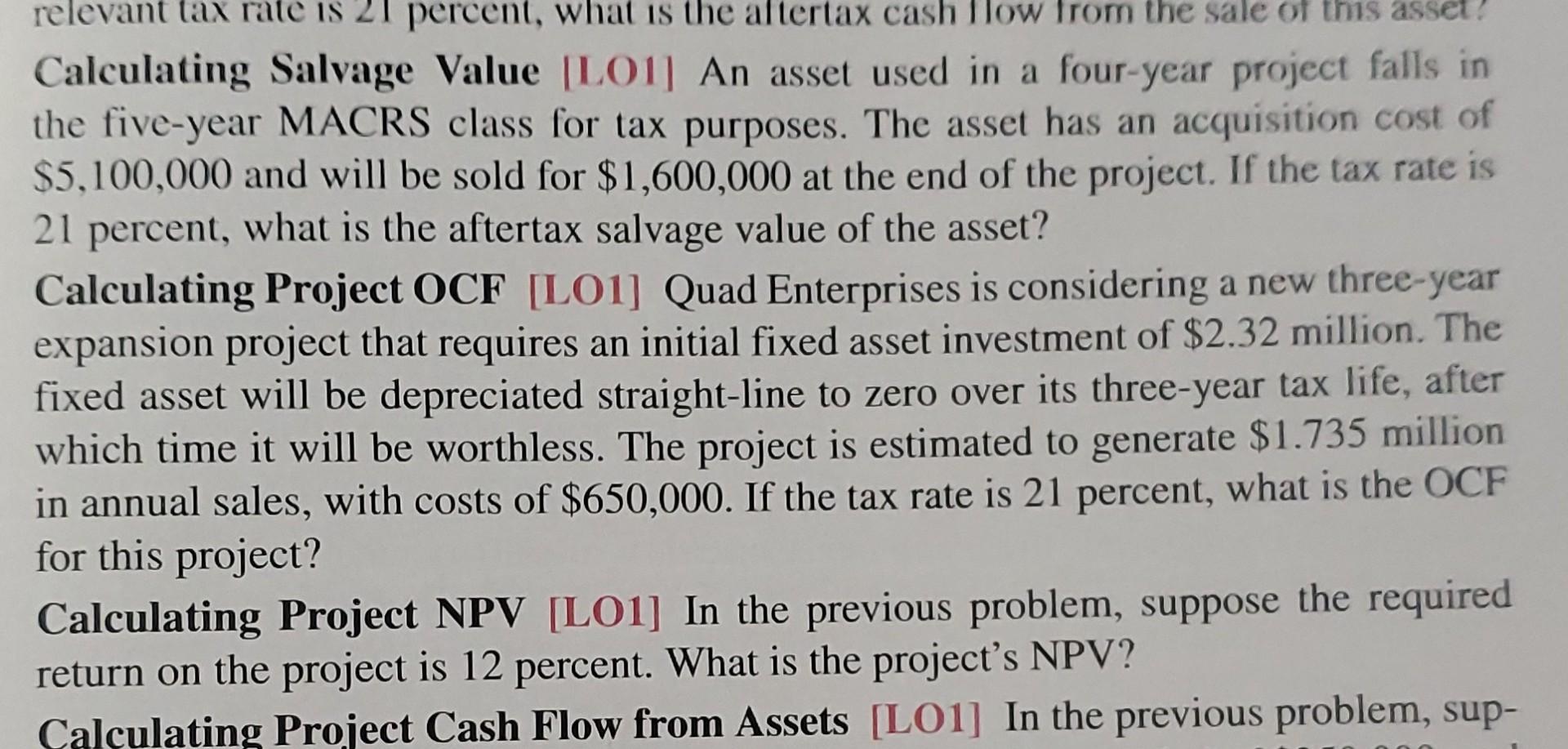

Calculating Salvage Value [LO1] An asset used in a four-year project falls in the five-year MACRS class for tax purposes. The asset has an acquisition cost of $5,100,000 and will be sold for $1,600,000 at the end of the project. If the tax rate is 21 percent, what is the aftertax salvage value of the asset? Calculating Project OCF [LO1] Quad Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2.32 million. The fixed asset will be depreciated straight-line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate $1.735 million in annual sales, with costs of $650,000. If the tax rate is 21 percent, what is the OCF for this project? Calculating Project NPV [LO1] In the previous problem, suppose the required return on the project is 12 percent. What is the project's NPV? Calculating Project Cash Flow from Assets [LO1] In the previous problem, sup

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts