Question: Please show steps in how to solve those questions. 2. A stock will not pay a dividend for 8 years. At the end of the

Please show steps in how to solve those questions.

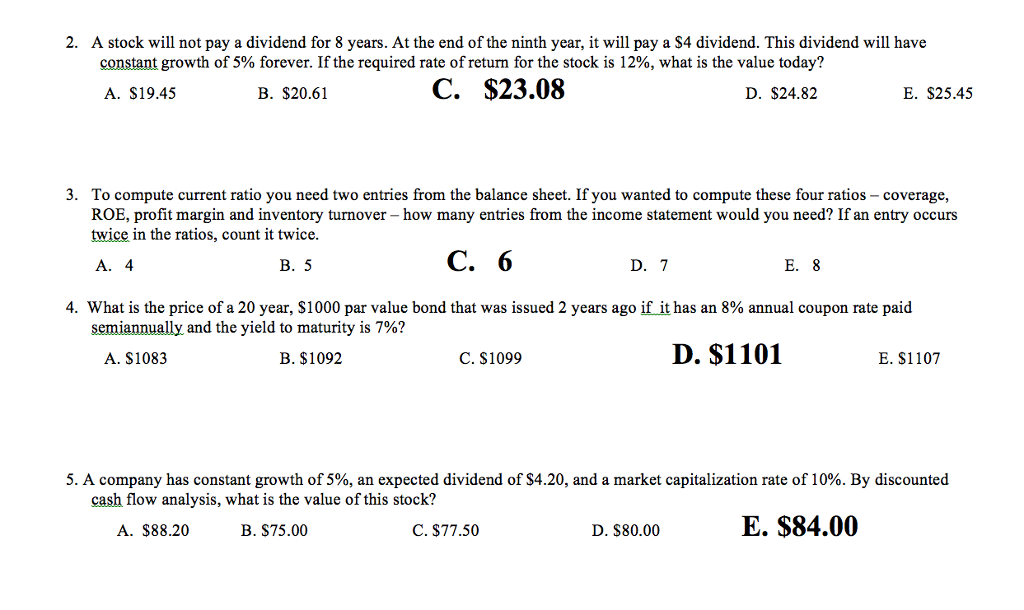

2. A stock will not pay a dividend for 8 years. At the end of the ninth year, it will pay a S4 dividend. This dividend will have constant growth of 5% forever. If the required rate of return for the stock is 12%, what is the value today? A. S19.45 B. $20.61 C. $23.08 D. $24.82 E. $25.4:5 3. To compute current ratio you need two entries from the balance sheet. If you wanted to compute these four ratios - coverage, ROE, profit margin and inventory turnover - how many entries from the income statement would you need? If an entry occurs twice in the ratios, count it twice C. 6 A. 4 B. 5 D. 7 E. 8 4. What is the price of a 20 year, $1000 par value bond that was issued 2 years ago if it has an 8% annual coupon rate paid semiannually and the yield to maturity is 7%? A. S1083 B. $1092 C. $1099 D. $110:1 E. S1107 5. A company has constant growth of 5%, an expected dividend of $4.20, and a market capitalization rate of 10%. By discounted cash flow analysis, what is the value of this stock! A. $88.20 B. S75.00 C. $77.50 D. S80.00 E. $84.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts