Question: Please show steps Mitch bought a newly issued $2,000 par-value 12% eight-year bond with semiannual coupons. The bond was priced to yield a nominal 6%,

Please show steps

Please show steps

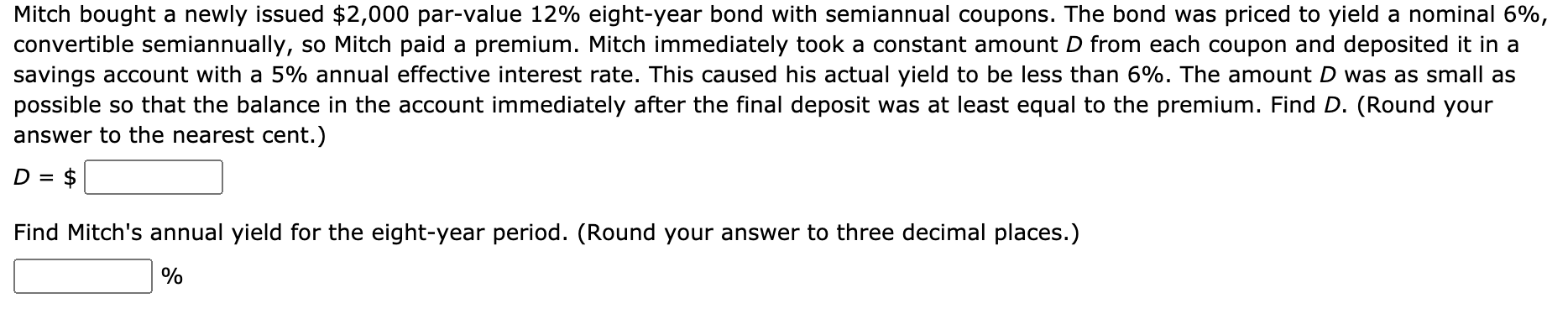

Mitch bought a newly issued $2,000 par-value 12% eight-year bond with semiannual coupons. The bond was priced to yield a nominal 6%, convertible semiannually, so Mitch paid a premium. Mitch immediately took a constant amount D from each coupon and deposited it in a savings account with a 5% annual effective interest rate. This caused his actual yield to be less than 6%. The amount D was as small as possible so that the balance in the account immediately after the final deposit was at least equal to the premium. Find D. (Round your answer to the nearest cent.) D = $ Find Mitch's annual yield for the eight-year period. (Round your answer to three decimal places.) %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts