Question: Please show steps NOT ON SPREADSHEET. if there is an easier way on calculator please show steps. thank you! NPV and Bonus Depreciation: Eggz, Inc.,

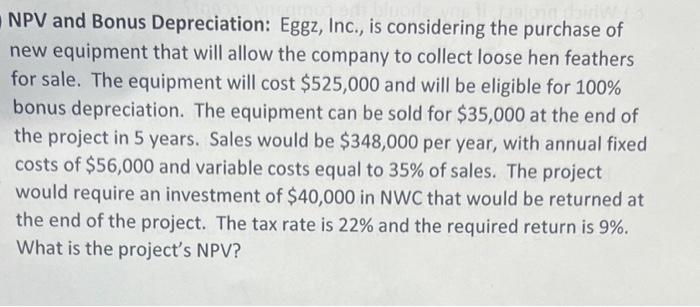

NPV and Bonus Depreciation: Eggz, Inc., is considering the purchase of new equipment that will allow the company to collect loose hen feathers for sale. The equipment will cost $525,000 and will be eligible for 100% bonus depreciation. The equipment can be sold for $35,000 at the end of the project in 5 years. Sales would be $348,000 per year, with annual fixed costs of $56,000 and variable costs equal to 35% of sales. The project would require an investment of $40,000 in NWC that would be returned at the end of the project. The tax rate is 22% and the required return is 9%. What is the project's NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts