Question: Please show steps on how you got answer 1. On August 2, 2020, A, B & C form a general partnership (ABC) in which each

Please show steps on how you got answer

Please show steps on how you got answer

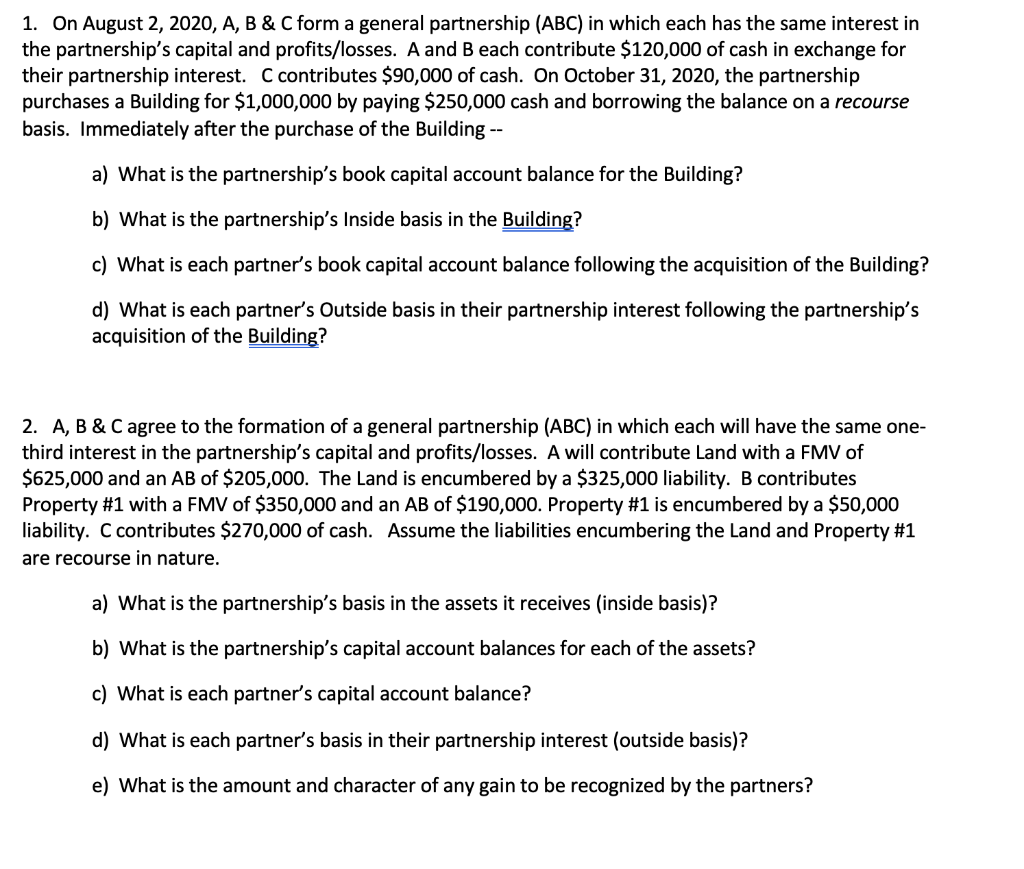

1. On August 2, 2020, A, B \& C form a general partnership (ABC) in which each has the same interest in the partnership's capital and profits/losses. A and B each contribute $120,000 of cash in exchange for their partnership interest. C contributes $90,000 of cash. On October 31,2020 , the partnership purchases a Building for $1,000,000 by paying $250,000 cash and borrowing the balance on a recourse basis. Immediately after the purchase of the Building -- a) What is the partnership's book capital account balance for the Building? b) What is the partnership's Inside basis in the Building? c) What is each partner's book capital account balance following the acquisition of the Building? d) What is each partner's Outside basis in their partnership interest following the partnership's acquisition of the Building? 2. A, B \& C agree to the formation of a general partnership (ABC) in which each will have the same onethird interest in the partnership's capital and profits/losses. A will contribute Land with a FMV of $625,000 and an AB of $205,000. The Land is encumbered by a $325,000 liability. B contributes Property \#1 with a FMV of $350,000 and an AB of $190,000. Property #1 is encumbered by a $50,000 liability. C contributes $270,000 of cash. Assume the liabilities encumbering the Land and Property \#1 are recourse in nature. a) What is the partnership's basis in the assets it receives (inside basis)? b) What is the partnership's capital account balances for each of the assets? c) What is each partner's capital account balance? d) What is each partner's basis in their partnership interest (outside basis)? e) What is the amount and character of any gain to be recognized by the partners

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts