Question: please show steps pls show steps to these problems! 4) (Chapter 6) - Consider the bond in question 3. If the bond is selling for

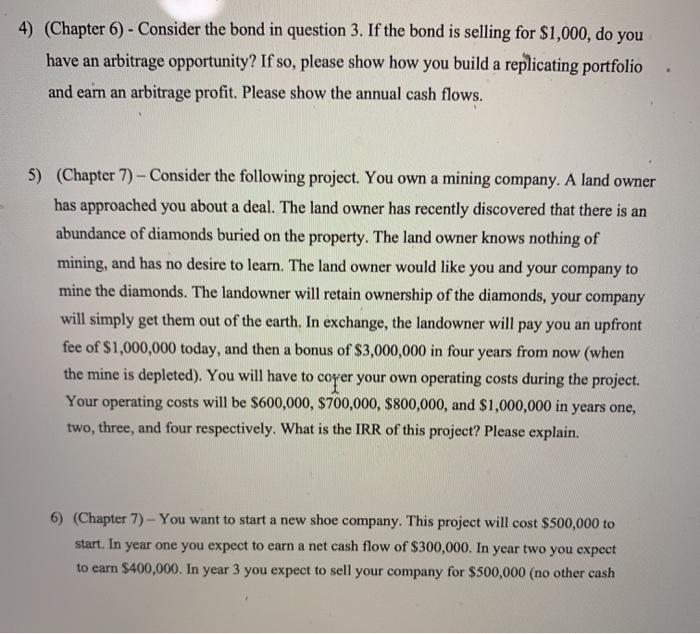

4) (Chapter 6) - Consider the bond in question 3. If the bond is selling for $1,000, do you have an arbitrage opportunity? If so, please show how you build a replicating portfolio and earn an arbitrage profit. Please show the annual cash flows. 5) (Chapter 7) - Consider the following project. You own a mining company. A land owner has approached you about a deal. The land owner has recently discovered that there is an abundance of diamonds buried on the property. The land owner knows nothing of mining, and has no desire to learn. The land owner would like you and your company to mine the diamonds. The landowner will retain ownership of the diamonds, your company will simply get them out of the earth. In exchange, the landowner will pay you an upfront fee of $1,000,000 today, and then a bonus of $3,000,000 in four years from now (when the mine is depleted). You will have to cover your own operating costs during the project. Your operating costs will be $600,000, $700,000, $800,000, and $1,000,000 in years one, two, three, and four respectively. What is the IRR of this project? Please explain. 6) (Chapter 7) - You want to start a new shoe company. This project will cost $500,000 to start. In year one you expect to earn a net cash flow of $300,000. In year two you expect to earn $400,000. In year 3 you expect to sell your company for $500,000 (no other cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts