Question: please show steps Practice problems 1. If you have $150 today and would like to have S300 eight years from now, what annual compounded rate

please show steps

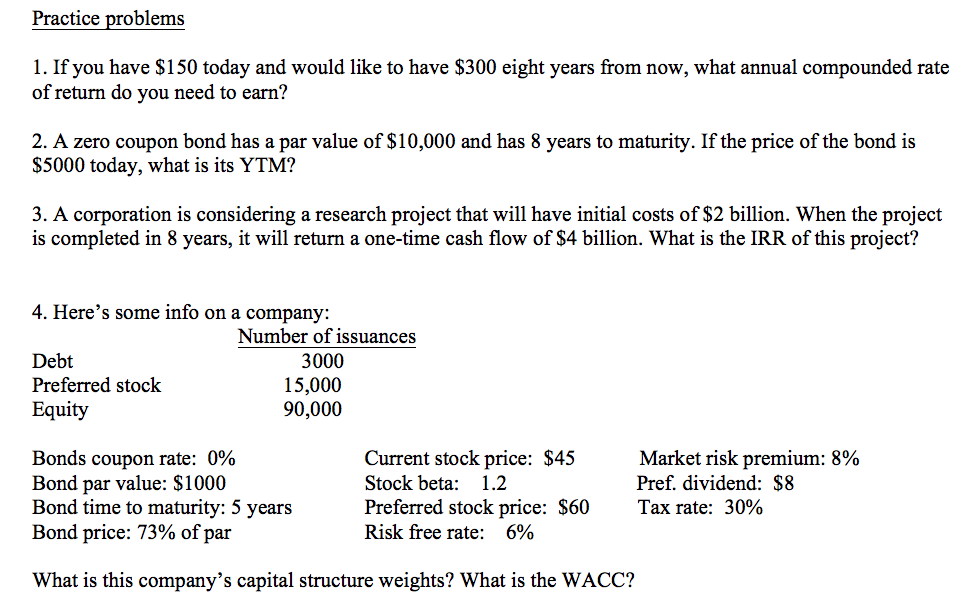

Practice problems 1. If you have $150 today and would like to have S300 eight years from now, what annual compounded rate of return do you need to earn? 2. A zero coupon bond has a par value of $10,000 and has 8 years to maturity. If the price of the bond is S5000 today, what is its YTM? 3. A corporation is considering a research project that will have initial costs of $2 billion. When the project is completed in 8 years, it will return a one-time cash flow of $4 billion. What is the IRR of this project? 4. Here's some info on a company: Number of issuances Debt Preferred stock 3000 15,000 90,000 ul Bonds coupon rate: 0% Bond par value: $1000 Bond time to maturity: 5 years Bond price: 73% of par Current stock price: $45 Stock beta: 1.2 Preferred stock price: $60 Risk free rate: 6% Market risk premium: 8% Pref. dividend: $8 Tax rate: 30% What is this company's capital structure weights? What is the WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts