Question: -please show steps to each of the problems ! Question 10 0/1 pts Cornerstone Industries has a bond outstanding that has a 5% coupon rate,

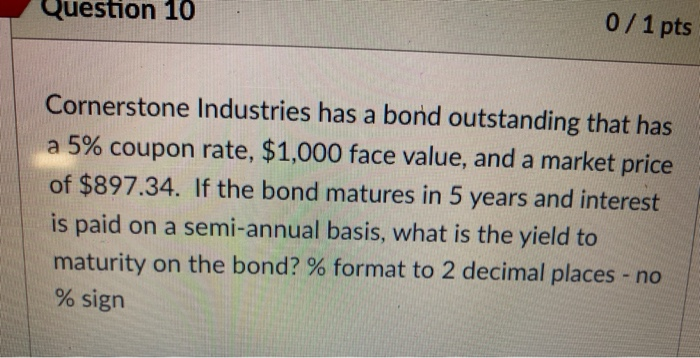

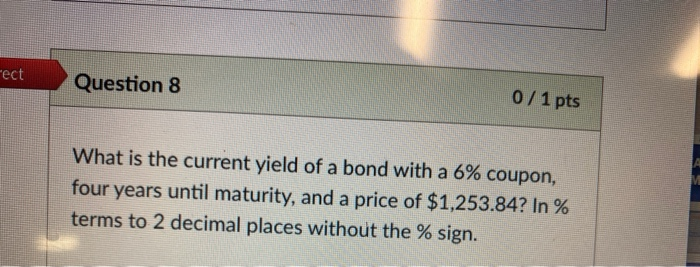

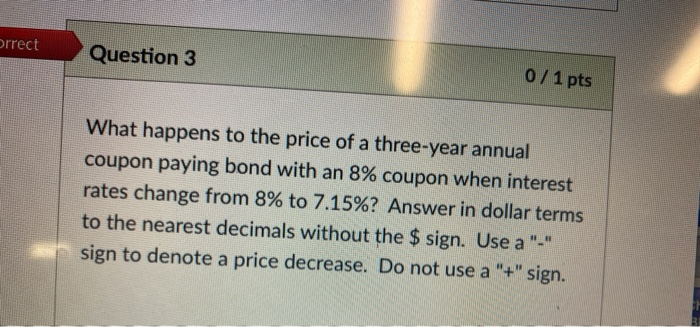

Question 10 0/1 pts Cornerstone Industries has a bond outstanding that has a 5% coupon rate, $1,000 face value, and a market price of $897.34. If the bond matures in 5 years and interest is paid on a semi-annual basis, what is the yield to maturity on the bond? % format to 2 decimal places - no % sign -eet Question 8 0 / 1 pts What is the current yield of a bond with a 6% coupon, four years until maturity, and a price of $1,253.84? In % terms to 2 decimal places without the % sign. Orrect Question 3 0 / 1 pts What happens to the price of a three-year annual coupon paying bond with an 8% coupon when interest rates change from 8% to 7.15%? Answer in dollar terms to the nearest decimals without the $ sign. Use a sign to denote a price decrease. Do not use a "+" sign

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts