Question: please show steps to solve 6. Westcon is considering building a facility to tap thermal energy using wind power. Part of the project's cost, $750,000,

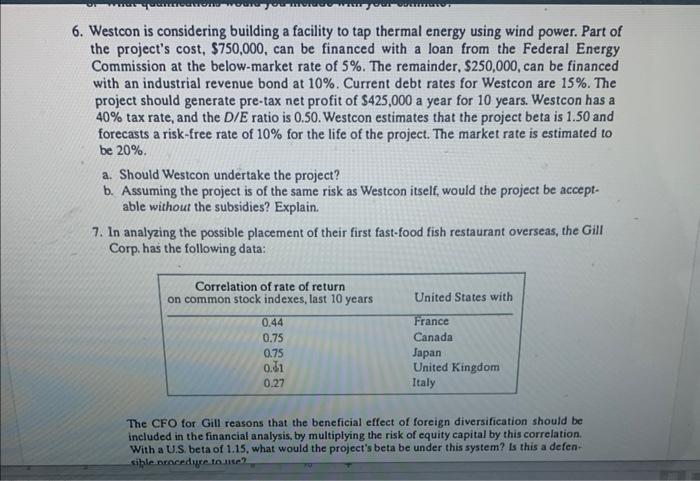

6. Westcon is considering building a facility to tap thermal energy using wind power. Part of the project's cost, $750,000, can be financed with a loan from the Federal Energy Commission at the below-market rate of 5%. The remainder, $250,000, can be financed with an industrial revenue bond at 10%. Current debt rates for Westcon are 15%. The project should generate pre-tax net profit of $425,000 a year for 10 years. Westcon has a 40% tax rate, and the D/E ratio is 0.50. Westcon estimates that the project beta is 1.50 and forecasts a risk-free rate of 10% for the life of the project. The market rate is estimated to be 20%. a. Should Westcon undertake the project? b. Assuming the project is of the same risk as Westcon itself, would the project be acceptable without the subsidies? Explain. 7. In analyzing the possible placement of their first fast-food fish restaurant overseas, the Gill Corp. has the following data: The CFO for Gill reasons that the beneficial effect of foreign diversification should be included in the financial analysis, by multiplying the risk of equity capital by this correlation. With a U.S beta of 1.15, what would the project's beta be under this system? Is this a defensible nraceduce ta use

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts