Question: Please show steps to solve, not just final answer, and if there are any functions that can be done with a financial calculator's tools, please

Please show steps to solve, not just final answer, and if there are any functions that can be done with a financial calculator's tools, please include that.

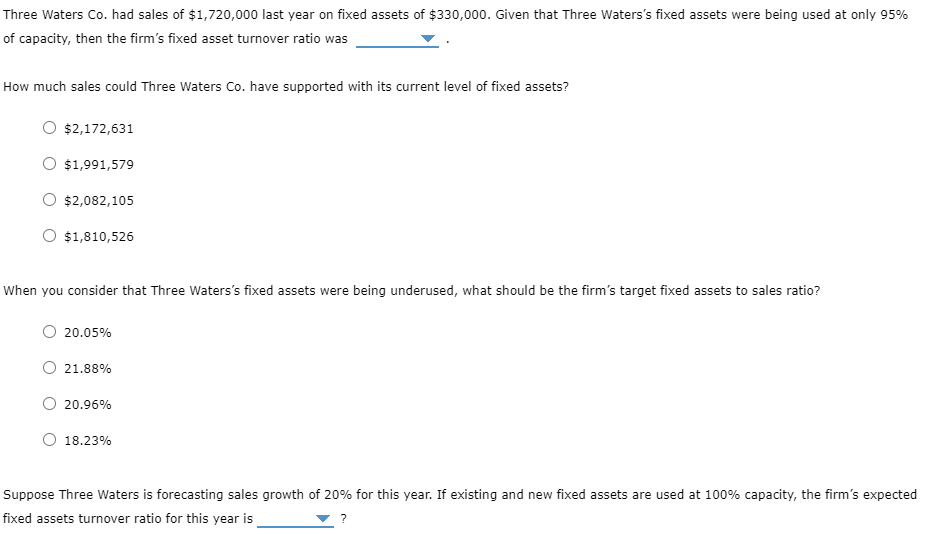

Three Waters Co. had sales of $1,720,000 last year on fixed assets of $330,000. Given that Three Waters's fixed assets were being used at only 95% of capacity, then the firm's fixed asset turnover ratio was How much sales could Three Waters Co. have supported with its current level of fixed assets? $2,172,631 $1,991,579 $2,082,105 $1,810,526 When you consider that Three Waters's fixed assets were being underused, what should be the firm's target fixed assets to sales ratio? 20.05% 21.88% 20.96% 18.23% Suppose Three Waters is forecasting sales growth of 20% for this year. If existing and new fixed assets are used at 100% capacity, the firm's expected fixed assets turnover ratio for this year is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts