Question: please show steps when solving 23) Hayesville Corporation had net income of $4 million this year on net sales of $125 million per year. At

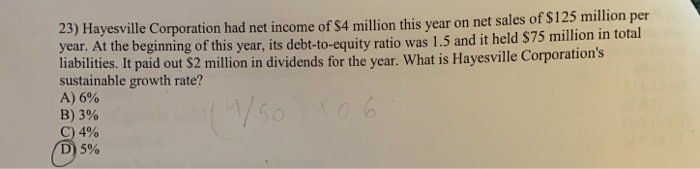

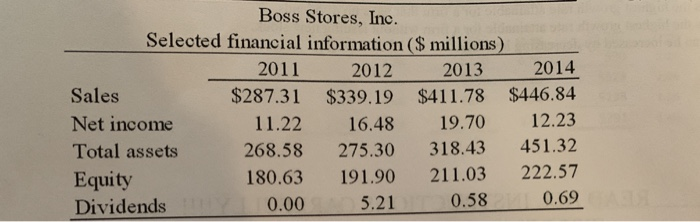

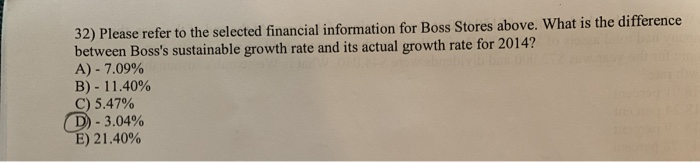

23) Hayesville Corporation had net income of $4 million this year on net sales of $125 million per year. At the beginning of this year, its debt-to-equity ratio was 1.5 and it held $75 million in total liabilities. It paid out $2 million in dividends for the year. What is Hayesville Corporation's sustainable growth rate? A) 6% B) 3% C) 4% D) 5% Boss Stores, Inc. Selected financial information ($ millions) 2011 2014 2012 2013 $339.19 $411.78 $446.84 12.23 Sales $287.31 Net income 11.22 16.48 19.70 451.32 268.58 Total assets 275.30 318.43 222.57 211.03 191.90 180.63 Equity Dividends 0.69 0.58 5.21 0.00 32) Please refer to the selected financial information for Boss Stores above. What is the difference between Boss's sustainable growth rate and its actual growth rate for 2014? A) 7.09% B)- 11.40% C) 5.47% D-3.04% E) 21.40%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts