Question: please show the answer in excel thx YMMV Inc. issues a bond with a face value of $65,000,000 with a coupon rate of 8.750% maturing

please show the answer in excel thx

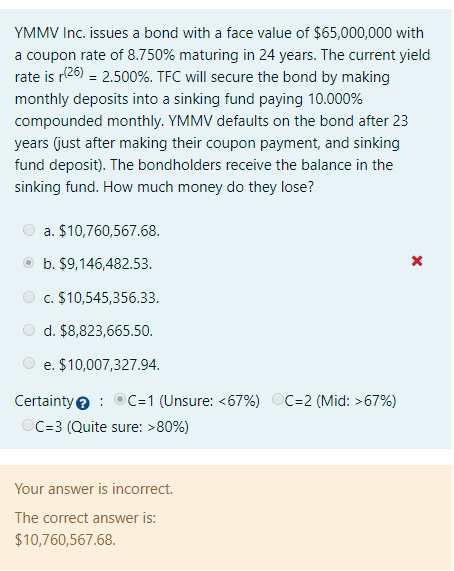

YMMV Inc. issues a bond with a face value of $65,000,000 with a coupon rate of 8.750% maturing in 24 years. The current yield rate is r(26) = 2.500%. TFC will secure the bond by making monthly deposits into a sinking fund paying 10.000% compounded monthly. YMMV defaults on the bond after 23 years (just after making their coupon payment, and sinking fund deposit). The bondholders receive the balance in the sinking fund. How much money do they lose? a. $10,760,567.68 b. $9,146,482.53. X c. $10,545,356.33. d. $8,823,665.50 e. $10,007,327.94. Certainty : C=1 (Unsure: 67%) C=3 (Quite sure: >80%) Your answer is incorrect. The correct answer is: $10,760,567.68

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts