Question: please show the break down for this problem and the answer. Thank you! The Foundational 15 (Static) [LO13-1, LO13-2] [The following information applies to the

![you! The Foundational 15 (Static) [LO13-1, LO13-2] [The following information applies to](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66ec4bd3dbe55_93966ec4bd3781bf.jpg)

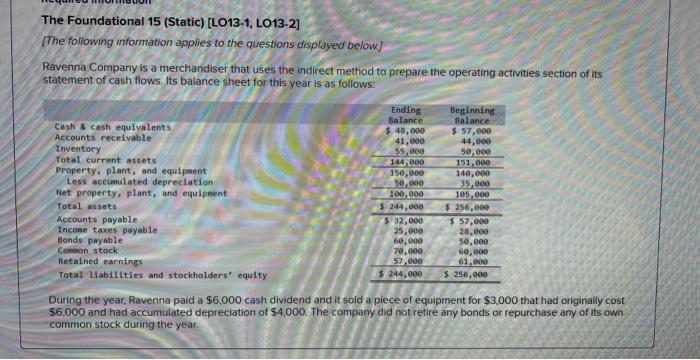

The Foundational 15 (Static) [LO13-1, LO13-2] [The following information applies to the questions displayed below.] Ravenna Company is a merchandiser that uses the indirect method to prepare the operating activities section of its statement of cash flows. Its balance sheet for this year is as follows. During the year, Ravenna paid a $6,000 cash dividend and it sold a piece of equipment for $3,000 that had originally cost $6,000 and had accumulated depreciation of $4,000. The company did not retire any bonds or repurchase any of its own common stock during the year. During the year, Ravenna paid a $6,000 cash dividend and it sold a piece of equipment for $3,000 that had originally cost $6.000 and had accumulated depreciation of $4.000. The company did not retire any bonds or repurchase any of its own common stock during the year. Foundational 13-3 (Static) 3. How much depreciation would the company add to net income on its statement of cash flows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts