Question: Please show the calculation and all steps in getting the answer for the paypack period. Hope Electronics Ltd is an established company which has continued

Please show the calculation and all steps in getting the answer for the paypack period.

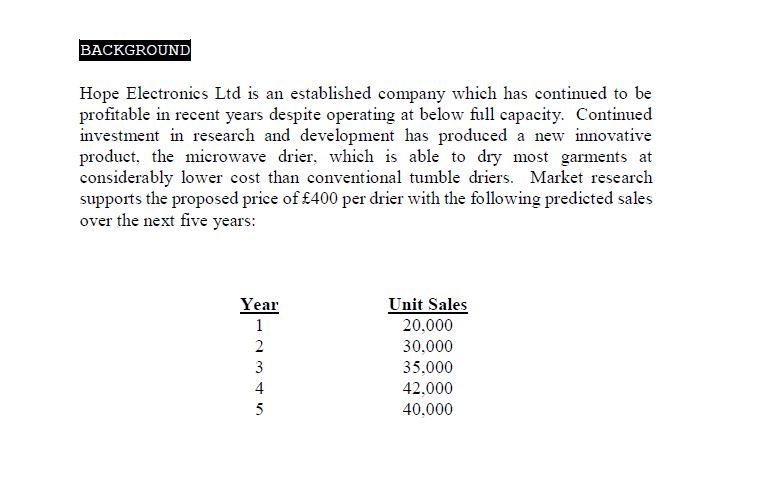

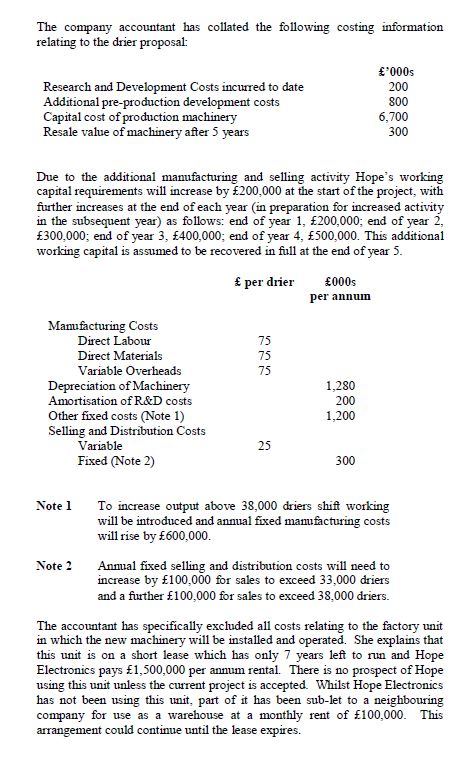

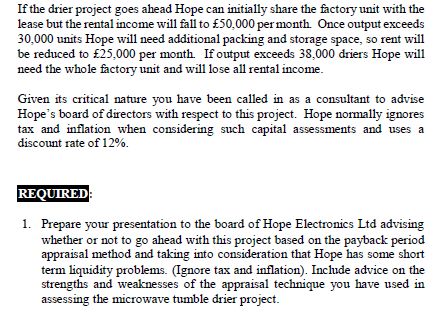

Hope Electronics Ltd is an established company which has continued to be profitable in recent years despite operating at below full capacity. Continued investment in research and development has produced a new innovative product, the microwave drier, which is able to dry most garments at considerably lower cost than conventional tumble driers. Market research supports the proposed price of 400 per drier with the following predicted sales over the next five years: The company accountant has collated the following costing information relating to the drier proposal: Due to the additional manufacturing and selling activity Hope's working capital requirements will increase by 200,000 at the start of the project, with further increases at the end of each year (in preparation for increased activity in the subsequent year) as follows: end of year 1,200,000; end of year 2 , 300,000; end of year 3,400,000; end of year 4,500,000. This additional working capital is assumed to be recovered in full at the end of year 5 . Note 1 To increase output above 38,000 driers shift working will be introduced and annual fixed manufacturing costs will rise by 600,000. Note 2 Annul fixed selling and distribution costs will need to increase by 100,000 for sales to exceed 33,000 driers and a further 100,000 for sales to exceed 38,000 driers. The accountant has specifically excluded all costs relating to the factory unit in which the new machinery will be installed and operated. She explains that this unit is on a short lease which has only 7 years left to run and Hope Electronics pays 1,500,000 per annum rental. There is no prospect of Hope using this unit unless the current project is accepted. Whilst Hope Electronics has not been using this unit, part of it has been sub-let to a neighbouring company for use as a warehouse at a monthly rent of 100,000. This arrangement could continue until the lease expires. If the drier project goes ahead Hope can initially share the factory unit with the lease but the rental income will fall to 50,000 per month. Once output exceeds 30,000 units Hope will need additional packing and storage space, so rent will be reduced to 25,000 per month. If output exceeds 38,000 driers Hope will need the whole factory unit and will lose all rental income. Given its critical nature you have been called in as a consultant to advise Hope's board of directors with respect to this project. Hope normally ignores tax and inflation when considering such capital assessments and uses a discount rate of 12%. REQUIRED: 1. Prepare your presentation to the board of Hope Electronics Ltd advising whether or not to go ahead with this project based on the payback period appraisal method and taking into consideration that Hope has some short term liquidity problems. (Ignore tax and inflation). Include advice on the strengths and weaknesses of the appraisal technique you have used in assessing the microwave tumble drier project. Hope Electronics Ltd is an established company which has continued to be profitable in recent years despite operating at below full capacity. Continued investment in research and development has produced a new innovative product, the microwave drier, which is able to dry most garments at considerably lower cost than conventional tumble driers. Market research supports the proposed price of 400 per drier with the following predicted sales over the next five years: The company accountant has collated the following costing information relating to the drier proposal: Due to the additional manufacturing and selling activity Hope's working capital requirements will increase by 200,000 at the start of the project, with further increases at the end of each year (in preparation for increased activity in the subsequent year) as follows: end of year 1,200,000; end of year 2 , 300,000; end of year 3,400,000; end of year 4,500,000. This additional working capital is assumed to be recovered in full at the end of year 5 . Note 1 To increase output above 38,000 driers shift working will be introduced and annual fixed manufacturing costs will rise by 600,000. Note 2 Annul fixed selling and distribution costs will need to increase by 100,000 for sales to exceed 33,000 driers and a further 100,000 for sales to exceed 38,000 driers. The accountant has specifically excluded all costs relating to the factory unit in which the new machinery will be installed and operated. She explains that this unit is on a short lease which has only 7 years left to run and Hope Electronics pays 1,500,000 per annum rental. There is no prospect of Hope using this unit unless the current project is accepted. Whilst Hope Electronics has not been using this unit, part of it has been sub-let to a neighbouring company for use as a warehouse at a monthly rent of 100,000. This arrangement could continue until the lease expires. If the drier project goes ahead Hope can initially share the factory unit with the lease but the rental income will fall to 50,000 per month. Once output exceeds 30,000 units Hope will need additional packing and storage space, so rent will be reduced to 25,000 per month. If output exceeds 38,000 driers Hope will need the whole factory unit and will lose all rental income. Given its critical nature you have been called in as a consultant to advise Hope's board of directors with respect to this project. Hope normally ignores tax and inflation when considering such capital assessments and uses a discount rate of 12%. REQUIRED: 1. Prepare your presentation to the board of Hope Electronics Ltd advising whether or not to go ahead with this project based on the payback period appraisal method and taking into consideration that Hope has some short term liquidity problems. (Ignore tax and inflation). Include advice on the strengths and weaknesses of the appraisal technique you have used in assessing the microwave tumble drier project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts