Question: please show the calculation step by step for Question 2) c) i) ii) iii) only. Thanks Critically discuss THREE (3) measures that an acquirer company

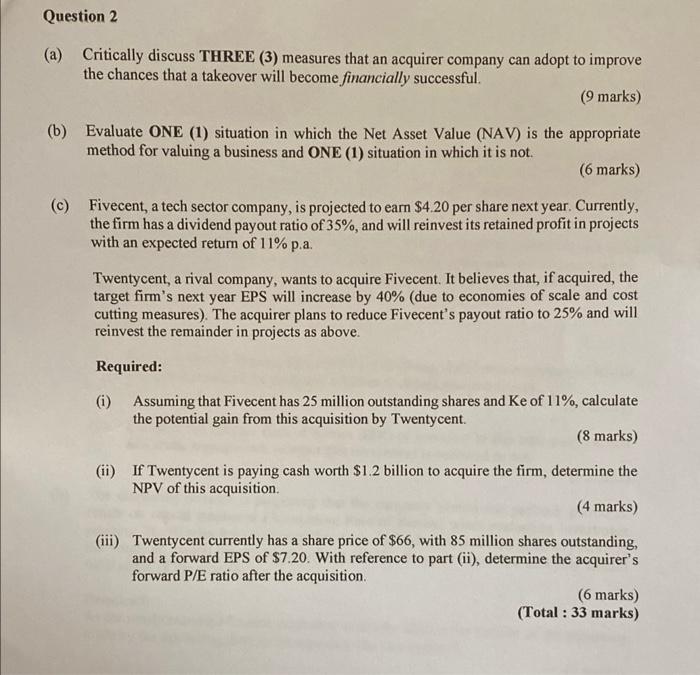

Critically discuss THREE (3) measures that an acquirer company can adopt to improve the chances that a takeover will become financially successful. (9 marks) Evaluate ONE (1) situation in which the Net Asset Value (NAV) is the appropriate method for valuing a business and ONE (1) situation in which it is not. (6 marks) c) Fivecent, a tech sector company, is projected to earn $4.20 per share next year. Currently, the firm has a dividend payout ratio of 35%, and will reinvest its retained profit in projects with an expected retum of 11% p.a. Twentycent, a rival company, wants to acquire Fivecent. It believes that, if acquired, the target firm's next year EPS will increase by 40% (due to economies of scale and cost cutting measures). The acquirer plans to reduce Fivecent's payout ratio to 25% and will reinvest the remainder in projects as above. Required: (i) Assuming that Fivecent has 25 million outstanding shares and Ke of 11%, calculate the potential gain from this acquisition by Twentycent. (8 marks) (ii) If Twentycent is paying cash worth $1.2 billion to acquire the firm, determine the NPV of this acquisition. (4 marks) (iii) Twentycent currently has a share price of $66, with 85 million shares outstanding, and a forward EPS of $7.20. With reference to part (ii), determine the acquirer's forward P/E ratio after the acquisition. (6 marks) (Total : 33 marks) Critically discuss THREE (3) measures that an acquirer company can adopt to improve the chances that a takeover will become financially successful. (9 marks) Evaluate ONE (1) situation in which the Net Asset Value (NAV) is the appropriate method for valuing a business and ONE (1) situation in which it is not. (6 marks) c) Fivecent, a tech sector company, is projected to earn $4.20 per share next year. Currently, the firm has a dividend payout ratio of 35%, and will reinvest its retained profit in projects with an expected retum of 11% p.a. Twentycent, a rival company, wants to acquire Fivecent. It believes that, if acquired, the target firm's next year EPS will increase by 40% (due to economies of scale and cost cutting measures). The acquirer plans to reduce Fivecent's payout ratio to 25% and will reinvest the remainder in projects as above. Required: (i) Assuming that Fivecent has 25 million outstanding shares and Ke of 11%, calculate the potential gain from this acquisition by Twentycent. (8 marks) (ii) If Twentycent is paying cash worth $1.2 billion to acquire the firm, determine the NPV of this acquisition. (4 marks) (iii) Twentycent currently has a share price of $66, with 85 million shares outstanding, and a forward EPS of $7.20. With reference to part (ii), determine the acquirer's forward P/E ratio after the acquisition. (6 marks) (Total : 33 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts