Question: PLEASE SHOW THE CALCULATION Titus Inc. opened a large bakery operation on January 1, 2019. At this time, the company's taxation year-end Is December 31.

PLEASE SHOW THE CALCULATION

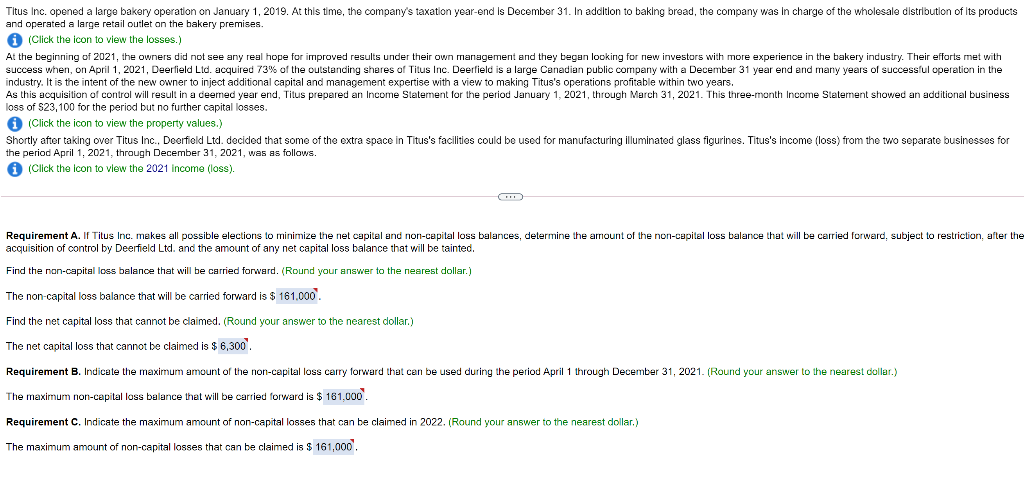

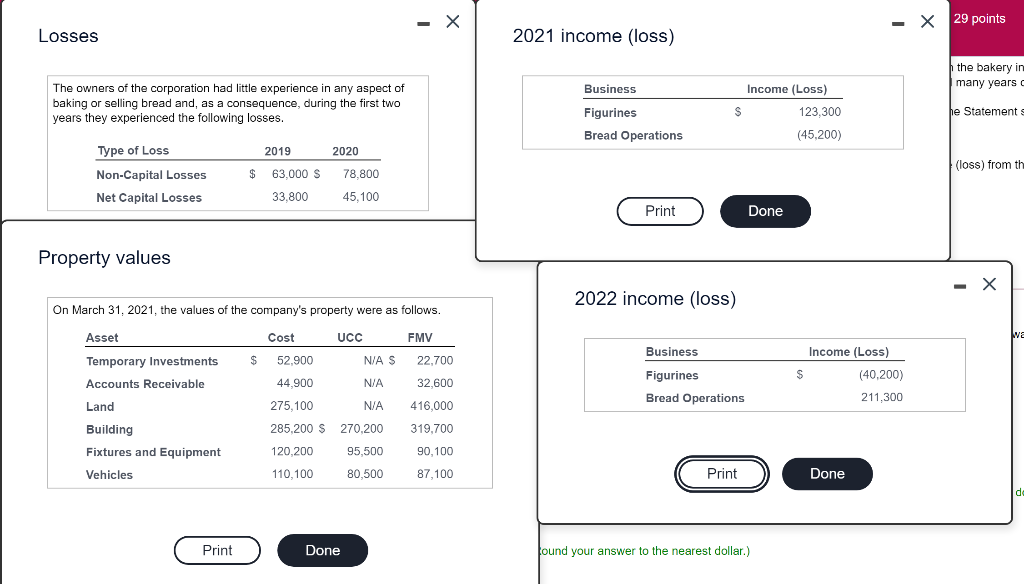

Titus Inc. opened a large bakery operation on January 1, 2019. At this time, the company's taxation year-end Is December 31. In addition to baking bread, the company was in charge of the wholesale distribution of its products and operated a large retail outlet on the bakery premises. (Click the icon to view the losses.) At the beginning of 2021, the owners did not see any real hope for improved results under their own management and they began looking for new investors with more experience in the bakery industry. Their efforts met with success when, on April 1, 2021, Deerfield Ltd. acquired 73% of the outstanding shares of Titus Inc. Deerfield is a large Canadian public company with a December 31 year end and many years of successful operation in the industry. It is the intent of the new owner to inject additional capital and management expertise with a view to making Titus's operations profitable within two years. As this acquisition of control will result in a deemed year end, Titus prepared an Income Statement for the period January 1, 2021, through March 31, 2021. This three-month Income Statement showed an additional business loss of $23,100 for the period but no further capital losses. (Click the icon to view the property values.) Shortly after taking over Titus Inc., Deerfield Ltd. decided that some of the extra space in Titus's facilities could be used for manufacturing illuminated glass figurines. Titus's income (loss) from the two separate businesses for the period April 1, 2021, through December 31, 2021, was as follows. (Click the icon to view the 2021 income (loss). Requirement A. If Titus Inc. makes all possible elections to minimize the net capital and non-capital loss balances, determine the arrount of the non-capital loss balance that will be carried forward, subject to restriction, after the acquisition of control by Deerfield Ltd. and the amount of any net capital loss balance that will be tainted. Find the non-capital loss balance that will be carried forward. (Round your answer to the nearest dollar. The non-capital loss balance that will be carried forward is $ 161.000 Find the net capital loss that cannot be claimed. (Round your answer to the nearest dollar.) The net capital loss that cannot be claimed is $ 6,300 Requirement B. Indicate the maximum amount of the non-capital loss carry forward that can be used during the period April 1 through December 31, 2021. (Round your answer to the nearest dollar.) The maximum non-capital loss balance that will be carried forward is $ 181,000 Requirement C. Indicate the maximum amount of non-capital losses that can be claimed in 2022. (Round your answer to the nearest dollar) The maximum amount of non-capital losses that can be claimed is $ 161,000 - X - - X 29 points Losses 2021 income (loss) the bakery in many years The owners of the corporation had little experience in any aspect of baking or selling bread and, as a consequence, during the first two years they experienced the following losses. Business Figurines Bread Operations Income (Loss) 123.300 $ he Statements (45,200) ) 2019 2020 (loss) from th Type of Loss Non-Capital Losses Net Capital Losses $ 63.000 S 78.800 33.800 45,100 Print Done Property values - X 2022 income (loss) On March 31, 2021, the values of the company's property were as follows. Asset UCC wa Cost $ 52,900 FMV 22,700 Business NAS $ Income (Loss) (40,200) 211,300 44.900 N/A Figurines Bread Operations 32,600 N/A 416,000 Temporary Investments Accounts Receivable Land Building Fixtures and Equipment Vehicles 275,100 285,200 $ 270.200 319,700 120.200 95,500 90,100 110,100 80,500 87,100 Print Done de Print Done Jound your answer to the nearest dollar.) Titus Inc. opened a large bakery operation on January 1, 2019. At this time, the company's taxation year-end Is December 31. In addition to baking bread, the company was in charge of the wholesale distribution of its products and operated a large retail outlet on the bakery premises. (Click the icon to view the losses.) At the beginning of 2021, the owners did not see any real hope for improved results under their own management and they began looking for new investors with more experience in the bakery industry. Their efforts met with success when, on April 1, 2021, Deerfield Ltd. acquired 73% of the outstanding shares of Titus Inc. Deerfield is a large Canadian public company with a December 31 year end and many years of successful operation in the industry. It is the intent of the new owner to inject additional capital and management expertise with a view to making Titus's operations profitable within two years. As this acquisition of control will result in a deemed year end, Titus prepared an Income Statement for the period January 1, 2021, through March 31, 2021. This three-month Income Statement showed an additional business loss of $23,100 for the period but no further capital losses. (Click the icon to view the property values.) Shortly after taking over Titus Inc., Deerfield Ltd. decided that some of the extra space in Titus's facilities could be used for manufacturing illuminated glass figurines. Titus's income (loss) from the two separate businesses for the period April 1, 2021, through December 31, 2021, was as follows. (Click the icon to view the 2021 income (loss). Requirement A. If Titus Inc. makes all possible elections to minimize the net capital and non-capital loss balances, determine the arrount of the non-capital loss balance that will be carried forward, subject to restriction, after the acquisition of control by Deerfield Ltd. and the amount of any net capital loss balance that will be tainted. Find the non-capital loss balance that will be carried forward. (Round your answer to the nearest dollar. The non-capital loss balance that will be carried forward is $ 161.000 Find the net capital loss that cannot be claimed. (Round your answer to the nearest dollar.) The net capital loss that cannot be claimed is $ 6,300 Requirement B. Indicate the maximum amount of the non-capital loss carry forward that can be used during the period April 1 through December 31, 2021. (Round your answer to the nearest dollar.) The maximum non-capital loss balance that will be carried forward is $ 181,000 Requirement C. Indicate the maximum amount of non-capital losses that can be claimed in 2022. (Round your answer to the nearest dollar) The maximum amount of non-capital losses that can be claimed is $ 161,000 - X - - X 29 points Losses 2021 income (loss) the bakery in many years The owners of the corporation had little experience in any aspect of baking or selling bread and, as a consequence, during the first two years they experienced the following losses. Business Figurines Bread Operations Income (Loss) 123.300 $ he Statements (45,200) ) 2019 2020 (loss) from th Type of Loss Non-Capital Losses Net Capital Losses $ 63.000 S 78.800 33.800 45,100 Print Done Property values - X 2022 income (loss) On March 31, 2021, the values of the company's property were as follows. Asset UCC wa Cost $ 52,900 FMV 22,700 Business NAS $ Income (Loss) (40,200) 211,300 44.900 N/A Figurines Bread Operations 32,600 N/A 416,000 Temporary Investments Accounts Receivable Land Building Fixtures and Equipment Vehicles 275,100 285,200 $ 270.200 319,700 120.200 95,500 90,100 110,100 80,500 87,100 Print Done de Print Done Jound your answer to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts