Question: please show the calculations -SOLVE COST METHOD: CONSOLIDATED STATEMENTS WORKPAPER- UPSTREAM SALES COST METHOD: CONSOLIDATED STATEMENTS WORKPAPER-UPSTREAM SALES IN THE NEWS Dell Inc. warned investors

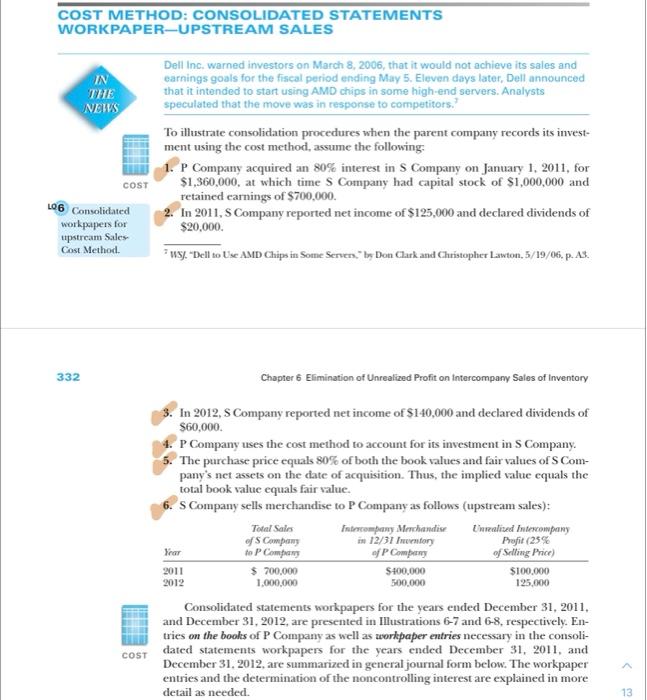

COST METHOD: CONSOLIDATED STATEMENTS WORKPAPER-UPSTREAM SALES IN THE NEWS Dell Inc. warned investors on March 8, 2006, that it would not achieve its sales and earnings goals for the fiscal period ending May 5. Eleven days later, Dell announced that it intended to start using AMD chips in some high-end servers. Analysts speculated that the move was in response to competitors. To illustrate consolidation procedures when the parent company records its invest- ment using the cost method, assume the following: 1. P Company acquired an 80% interest in s Company on January 1, 2011, for $1,860,000, at which time Company had capital stock of $1,000,000 and retained carnings of $700,000. 2. In 2011, Company reported net income of $125,000 and declared dividends of $20,000 WS). - Dell to Use AMD Chips in Some Servers" by Don Clark and Christopher Lawton, 5/19/06, p.AX. COST 106 Consolidated workpapers for upstream Sales Cost Method 332 Chapter 6 Elimination of Unrealized Profit on intercompany Sales of Inventory 3. In 2012, Company reported net income of $140,000 and declared dividends of $60,000 P Company uses the cost method to account for its investment in Company. The purchase price equals 80% of both the book values and fair values of Com- pany's net assets on the date of acquisition. Thus, the implied value equals the total book value equals fair value. 6. S Company sells merchandise to P Company as follows (upstream sales): Total Sains Intercompany Merchandise walised Intercompany of Company in 12/31 Fentory Prefit (25% Yrar to P Company of P Company of Selling Price) 2011 $ 700,000 $400,000 $100.000 2012 500,000 125,000 Consolidated statements workpapers for the years ended December 31, 2011, and December 31, 2012, are presented in Illustrations 6-7 and 6-8, respectively. En- tries on the books of P Company as well as workpaper entries necessary in the consoli- dated statements workpapers for the years ended December 31, 2011, and December 31, 2012, are summarized in general journal form below. The workpaper entries and the determination of the noncontrolling interest are explained in more detail as needed. 1.000.000 COST 13 COST METHOD: CONSOLIDATED STATEMENTS WORKPAPER-UPSTREAM SALES IN THE NEWS Dell Inc. warned investors on March 8, 2006, that it would not achieve its sales and earnings goals for the fiscal period ending May 5. Eleven days later, Dell announced that it intended to start using AMD chips in some high-end servers. Analysts speculated that the move was in response to competitors. To illustrate consolidation procedures when the parent company records its invest- ment using the cost method, assume the following: 1. P Company acquired an 80% interest in s Company on January 1, 2011, for $1,860,000, at which time Company had capital stock of $1,000,000 and retained carnings of $700,000. 2. In 2011, Company reported net income of $125,000 and declared dividends of $20,000 WS). - Dell to Use AMD Chips in Some Servers" by Don Clark and Christopher Lawton, 5/19/06, p.AX. COST 106 Consolidated workpapers for upstream Sales Cost Method 332 Chapter 6 Elimination of Unrealized Profit on intercompany Sales of Inventory 3. In 2012, Company reported net income of $140,000 and declared dividends of $60,000 P Company uses the cost method to account for its investment in Company. The purchase price equals 80% of both the book values and fair values of Com- pany's net assets on the date of acquisition. Thus, the implied value equals the total book value equals fair value. 6. S Company sells merchandise to P Company as follows (upstream sales): Total Sains Intercompany Merchandise walised Intercompany of Company in 12/31 Fentory Prefit (25% Yrar to P Company of P Company of Selling Price) 2011 $ 700,000 $400,000 $100.000 2012 500,000 125,000 Consolidated statements workpapers for the years ended December 31, 2011, and December 31, 2012, are presented in Illustrations 6-7 and 6-8, respectively. En- tries on the books of P Company as well as workpaper entries necessary in the consoli- dated statements workpapers for the years ended December 31, 2011, and December 31, 2012, are summarized in general journal form below. The workpaper entries and the determination of the noncontrolling interest are explained in more detail as needed. 1.000.000 COST 13

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts