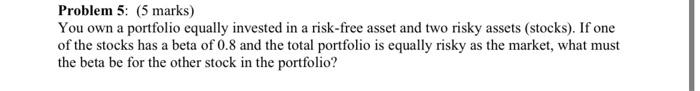

Question: please show the calculations (without excel) Problem 5: (5 marks) You own a portfolio equally invested in a risk-free asset and two risky assets (stocks).

Problem 5: (5 marks) You own a portfolio equally invested in a risk-free asset and two risky assets (stocks). If one of the stocks has a beta of 0.8 and the total portfolio is equally risky as the market, what must the beta be for the other stock in the portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts