Question: please show the entire question and working process included the formula. no excel generated.Thank you. Question 2 A Malaysian investor is considering constructing a portfolio

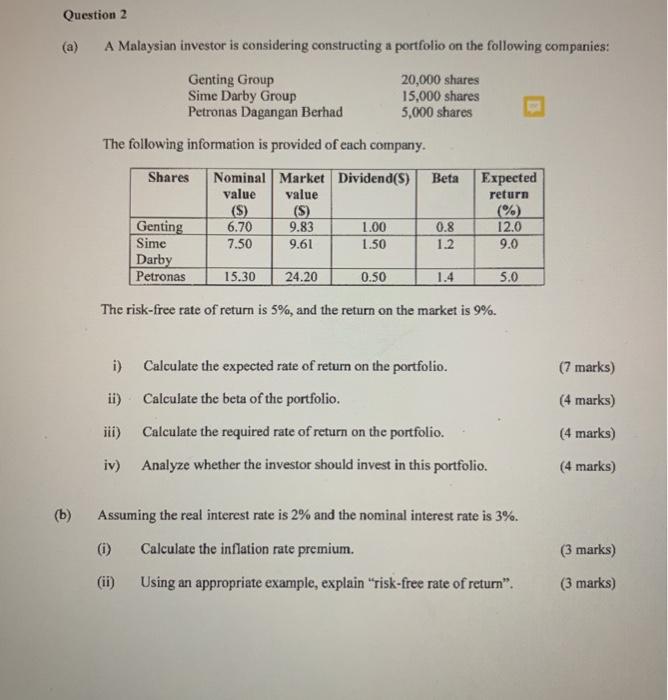

Question 2 A Malaysian investor is considering constructing a portfolio on the following companies: Genting Group Sime Darby Group Petronas Dagangan Berhad 20,000 shares 15,000 shares 5,000 shares The following information is provided of each company. Shares Beta Nominal Market Dividend(s) value value (S) (S) 6.70 9.83 1.00 7.50 9.61 1.50 Expected return (%) 12.0 9.0 0.8 1.2. Genting Sime Darby Petronas 15.30 24.20 0.50 1.4 5.0 The risk-free rate of return is 5%, and the return on the market is 9%. (7 marks) (4 marks) i) Calculate the expected rate of return on the portfolio. ii) Calculate the beta of the portfolio. iii) Calculate the required rate of return on the portfolio. iv) Analyze whether the investor should invest in this portfolio. (4 marks) (4 marks) (6) Assuming the real interest rate is 2% and the nominal interest rate is 3%. Calculate the inflation rate premium. (ii) Using an appropriate example, explain "risk-free rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts