Question: Please show the excel calculation. C. Because its financial position has strengthened considerably very recently, Argo Airlines is offered an interest rate swap - fixed

Please show the excel calculation.

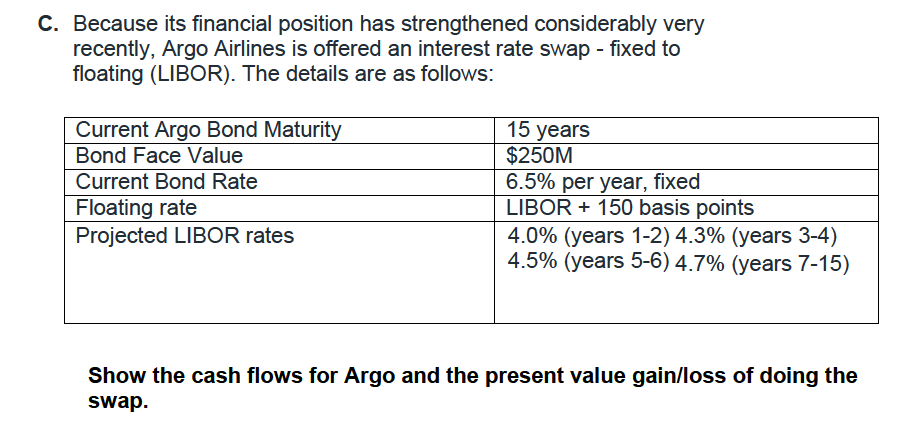

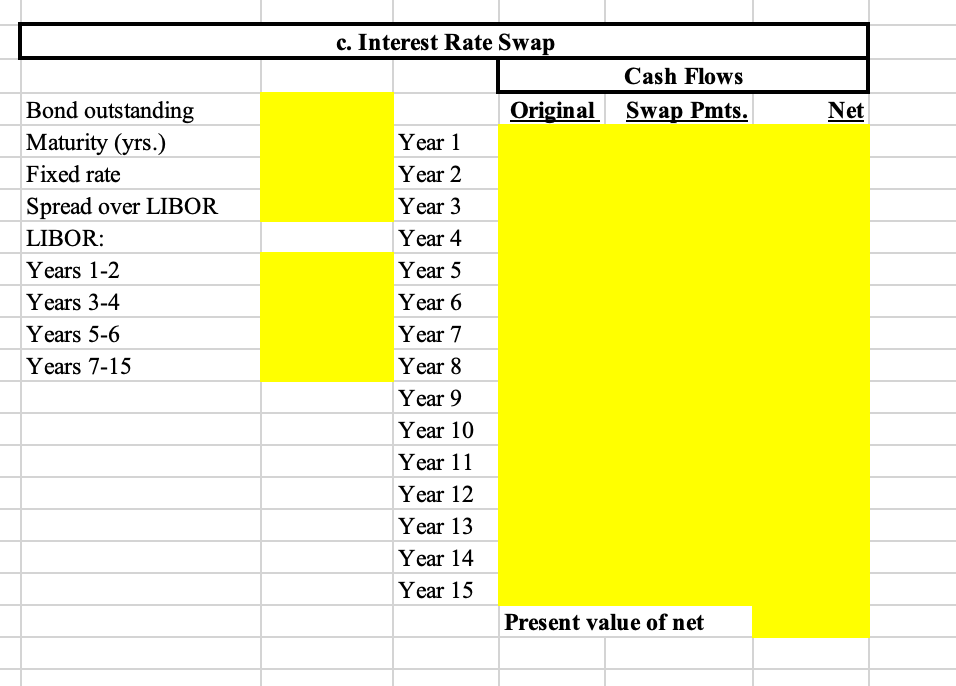

C. Because its financial position has strengthened considerably very recently, Argo Airlines is offered an interest rate swap - fixed to floating (LIBOR). The details are as follows: 15 years Current Argo Bond Maturity Bond Face Value Current Bond Rate Floating rate Projected LIBOR rates $250M 6.5% per year, fixed LIBOR + 150 basis points 4.0% (years 1-2) 4.3% (years 3-4) 4.5% (years 5-6) 4.7% (years 7-15) Show the cash flows for Argo and the present value gain/loss of doing the swap. c. Interest Rate Swap Cash Flows Original Swap Pmts. Net Bond outstanding Maturity (yrs.) Fixed rate Spread over LIBOR LIBOR: Years 1-2 Years 3-4 Years 5-6 Years 7-15 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Year 11 Year 12 Year 13 Year 14 Year 15 Present value of net C. Because its financial position has strengthened considerably very recently, Argo Airlines is offered an interest rate swap - fixed to floating (LIBOR). The details are as follows: 15 years Current Argo Bond Maturity Bond Face Value Current Bond Rate Floating rate Projected LIBOR rates $250M 6.5% per year, fixed LIBOR + 150 basis points 4.0% (years 1-2) 4.3% (years 3-4) 4.5% (years 5-6) 4.7% (years 7-15) Show the cash flows for Argo and the present value gain/loss of doing the swap. c. Interest Rate Swap Cash Flows Original Swap Pmts. Net Bond outstanding Maturity (yrs.) Fixed rate Spread over LIBOR LIBOR: Years 1-2 Years 3-4 Years 5-6 Years 7-15 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Year 11 Year 12 Year 13 Year 14 Year 15 Present value of net

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts