Question: please show the excel calculations. QUESTION 3. Use Excel Only for all the quantitative portions of this problem. As a consultant to an entrepreneur behind

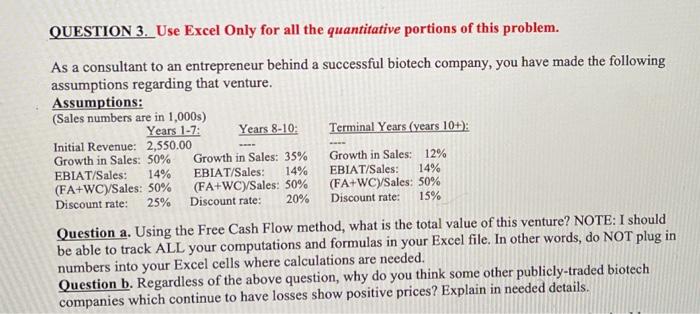

QUESTION 3. Use Excel Only for all the quantitative portions of this problem. As a consultant to an entrepreneur behind a successful biotech company, you have made the following assumptions regarding that venture. Assumptions: (Sales numbers are in 1,000s) Years 1-7: Years 8-10: Terminal Years (years 10+): Initial Revenue: 2,550.00 Growth in Sales: 50% Growth in Sales: 35% Growth in Sales: 12% EBIAT/Sales: 14% EBIAT/Sales: 14% EBIAT/Sales: 14% (FA+WC)Sales: 50% (FA+WC)/Sales: 50% (FA+WCY/Sales: 50% Discount rate: 25% Discount rate: 20% Discount rate: 15% Question a. Using the Free Cash Flow method, what is the total value of this venture? NOTE: I should be able to track ALL your computations and formulas in your Excel file. In other words, do NOT plug in numbers into your Excel cells where calculations are needed. Question b. Regardless of the above question, why do you think some other publicly-traded biotech companies which continue to have losses show positive prices? Explain in needed details

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts