Question: PLEASE SHOW THE EXCEL DOCMENT WITH THE FORMULAS FOR EACH ANSWER!!! Using the information below, answer the following questions: Annual Retirement 150,000 Income Need Years

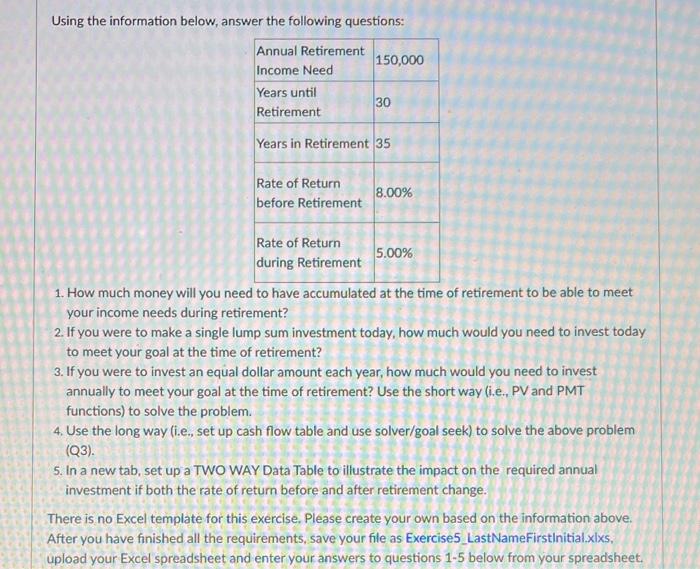

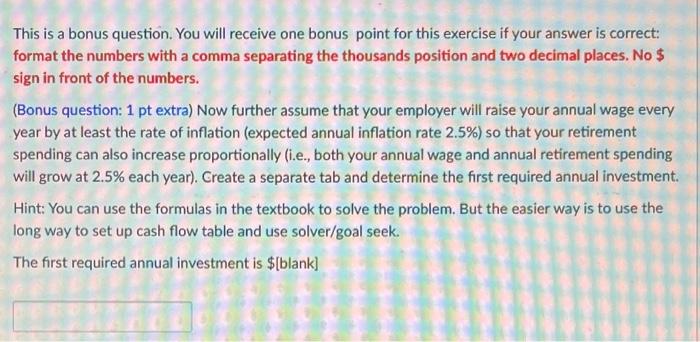

Using the information below, answer the following questions: Annual Retirement 150,000 Income Need Years until 30 Retirement Years in Retirement 35 Rate of Return before Retirement 8.00% Rate of Return during Retirement 5.00% 1. How much money will you need to have accumulated at the time of retirement to be able to meet your income needs during retirement? 2. If you were to make a single lump sum investment today, how much would you need to invest today to meet your goal at the time of retirement? 3. If you were to invest an equal dollar amount each year, how much would you need to invest annually to meet your goal at the time of retirement? Use the short way (i.e., PV and PMT functions) to solve the problem. 4. Use the long way (i.e., set up cash flow table and use solver/goal seek) to solve the above problem (Q3). s. In a new tab, set up a TWO WAY Data Table to illustrate the impact on the required annual investment if both the rate of return before and after retirement change. There is no Excel template for this exercise. Please create your own based on the information above. After you have finished all the requirements, save your file as Exercise5_LastNameFirstInitial.xlxs, upload your Excel spreadsheet and enter your answers to questions 1-5 below from your spreadsheet. This is a bonus question. You will receive one bonus point for this exercise if your answer is correct: format the numbers with a comma separating the thousands position and two decimal places. No $ sign in front of the numbers. (Bonus question: 1 pt extra) Now further assume that your employer will raise your annual wage every year by at least the rate of inflation (expected annual inflation rate 2.5%) so that your retirement spending can also increase proportionally (i.e., both your annual wage and annual retirement spending will grow at 2.5% each year). Create a separate tab and determine the first required annual investment Hint: You can use the formulas in the textbook to solve the problem. But the easier way is to use the long way to set up cash flow table and use solver/goal seek. The first required annual investment is $[blank]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts