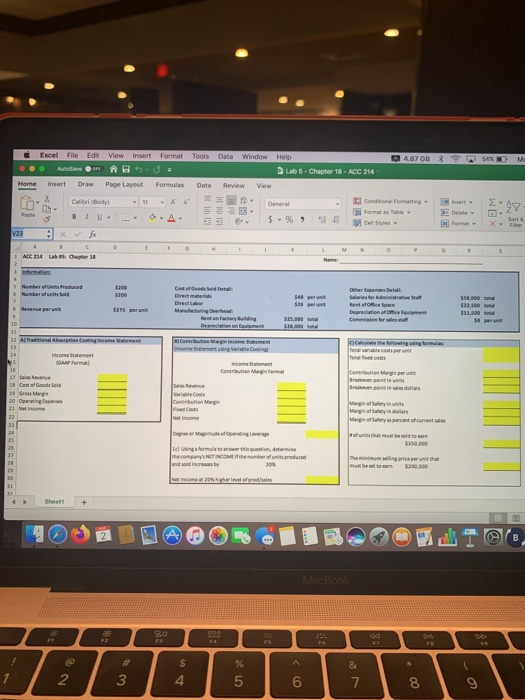

Question: Please show the Excel formula D478 M Help Labs - Chapter 18 - ACC 214 Excel file View insert Format Tools Data Window Avenu Home

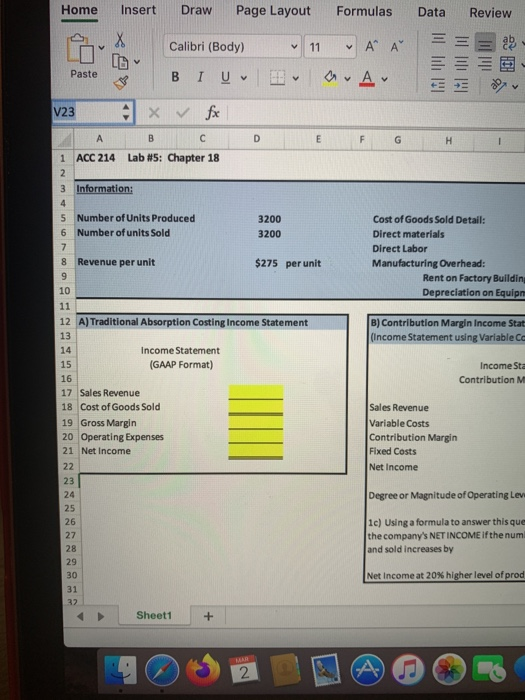

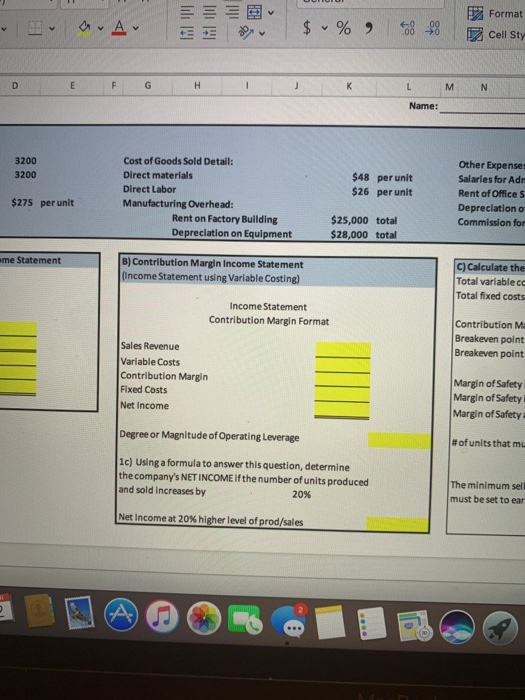

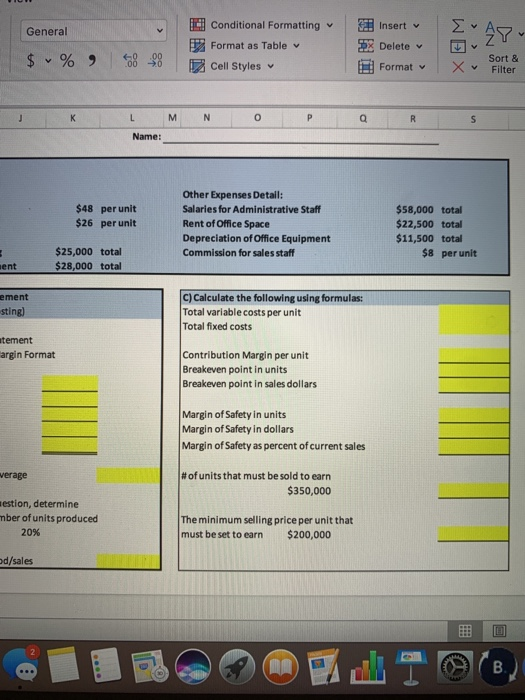

D478 M Help Labs - Chapter 18 - ACC 214 Excel file View insert Format Tools Data Window Avenu Home Insert Dr Page Layout Forms Data Review View Carlos AA 550.000 Al Traditional Artist Contributin Margi % & Home Insert Draw Page Layout Formulas Data Review Calibri (Body) 11 A A == LU I Paste B IU CA E V23 x & fx A B C D E F G 1 ACC 214 Lab #5: Chapter 18 Information: 5 Number of Units Produced 6 Number of units Sold 3200 3200 Cost of Goods Sold Detail: Direct materials Direct Labor Manufacturing Overhead: Rent on Factory Buildin Depreciation on Equip 8 Revenue per unit $275 per unit A) Traditional Absorption Costing Income Statement B) Contribution Margin Income Stat (Income Statement using Variable Income Statement (GAAP Format) Income Sta Contribution M 17 Sales Revenue 18 Cost of Goods Sold 19 Gross Margin 20 Operating Expenses 21 Net Income Sales Revenue Variable Costs Contribution Margin Fixed Costs Net Income Degree or Magnitude of Operating Lev 1c) Using a formula to answer this que the company's NET INCOME If the num and sold increases by Net Income at 20% higher level of prod Sheet1 0 3 2 TA OG - D A E $ Format cell Sty % 88 D E F G H I J Name: 3200 3200 $48 per unit $26 per unit Cost of Goods Sold Detail: Direct materials Direct Labor Manufacturing Overhead: Rent on Factory Building Depreciation on Equipment Other Expense Salaries for Ade Rent of Offices Depreciation o Commission for $275 per unit $25,000 total $28,000 total me Statement B) Contribution Margin Income Statement (Income Statement using Variable Costing) C) Calculate the Total variablece Total fixed costs Income Statement Contribution Margin Format Contribution M Breakeven point Breakeven point Sales Revenue Variable Costs Contribution Margin Fixed Costs Net Income Margin of Safety Margin of Safety Margin of Safety Degree or Magnitude of Operating Leverage #of units that my 1c) Using a formula to answer this question, determine the company's NET INCOME if the number of units produced and sold increases by 20% The minimum sel must be set to ear Net Income at 20% higher level of prod/sales General $ % Conditional Formatting 2 Format as Table Cell Styles Insert DX Delete Format 68 X Sort & Filter L M N O P Q R Name: $48 per unit $26 per unit Other Expenses Detail: Salaries for Administrative Staff Rent of Office Space Depreciation of Office Equipment Commission for sales staff $58,000 total $22,500 total $11,500 total $8 per unit $25,000 total $28,000 total ent ement sting) c) Calculate the following using formulas: Total variable costs per unit Total fixed costs atement argin Format Contribution Margin per unit Breakeven point in units Breakeven point in sales dollars Margin of Safety in units Margin of Safety in dollars Margin of Safety as percent of current sales verage # of units that must be sold to earn $350,000 estion, determine nber of units produced 20% The minimum selling price per unit that must be set to earn $200,000 d/sales

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts