Question: PLEASE SHOW THE EXCEL FORMULAS FOR EVERY ANSWER THANKS! Planning for Capital Investments - Excel FILE PAGE LAYOUT FORMULAS DATA REVIEW VIEW A A %

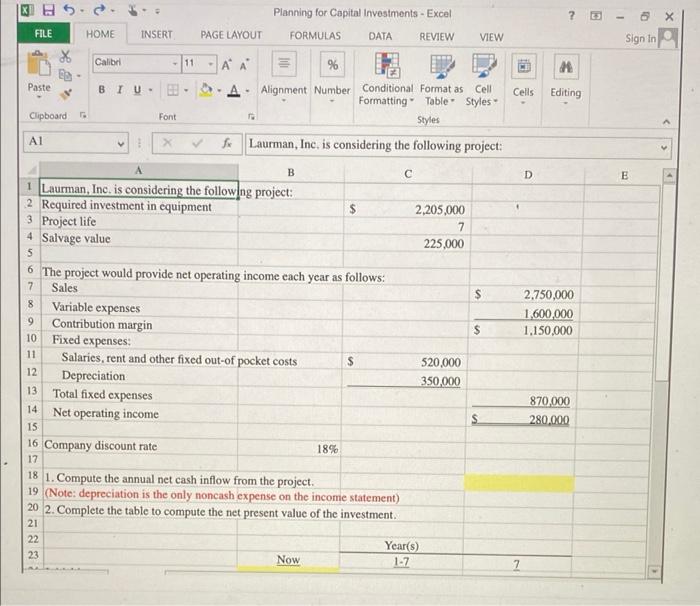

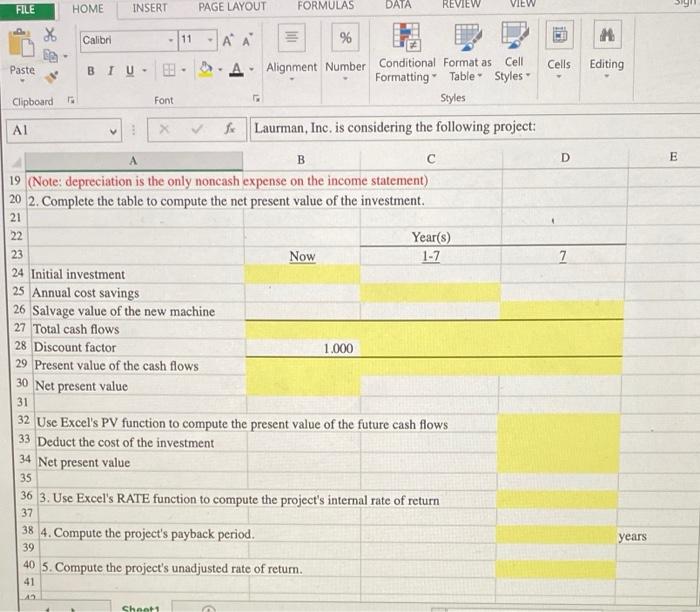

Planning for Capital Investments - Excel FILE PAGE LAYOUT FORMULAS DATA REVIEW VIEW A A % Paste A Alignment Number Conditional Format as Cell . Formatting Table Styles Clipboard Font T Styles Al X fx Laurman, Inc. is considering the following project: A B C 1 Laurman, Inc. is considering the following project: 2 Required investment in equipment $ 2,205,000 7 3 Project life 4 Salvage value 225,000 5 6 The project would provide net operating income each year as follows: 7 Sales 8 Variable expenses 9 Contribution margin 10 Fixed expenses: 11 Salaries, rent and other fixed out-of pocket costs S 12 Depreciation 13 Total fixed. expenses 14 Net operating income 15 16 Company discount rate 18% 17 18 1. Compute the annual net cash inflow from the project. 19 (Note: depreciation is the only noncash expense on the income statement) 20 2. Complete the table to compute the net present value of the investment. 21 22 Year(s) 1-7 23 Now C. HOME INSERT Calibri BIU- -11 W 520,000 350,000 $ $ Cells 7 ? M Editing D 2,750,000 1,600,000 1,150,000 870,000 280,000 1 5 X Sign In E 1 4 FORMULAS REVIEW DATA PAGE LAYOUT VIEW FILE A A % Paste BIU ' Alignment Number Conditional Format as Cell Formatting Table Styles F Styles Clipboard Al 1 Laurman, Inc. is considering the following project: A B C 19 (Note: depreciation is the only noncash expense on the income statement) 20 2. Complete the table to compute the net present value of the investment. 21 22 Year(s) 1-7 23 Now 24 Initial investment 25 Annual cost savings 26 Salvage value of the new machine 27 Total cash flows 28 Discount factor 1.000 29 Present value of the cash flows 30 Net present value 31 32 Use Excel's PV function to compute the present value of the future cash flows 33 Deduct the cost of the investment 34 Net present value 35 36 3. Use Excel's RATE function to compute the project's internal rate of return 37 38 4. Compute the project's payback period. 39 40 5. Compute the project's unadjusted rate of return. 41 42. Sheet1 HOME Calibri INSERT - 11 88- Font Cells D 7 M Editing years E

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts