Question: Please show the excel functions. Thank you so much. 3) Let's assume we are a heating oil delivery service company that sells 100,000 gallons of

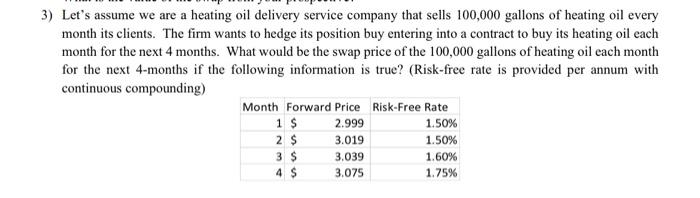

3) Let's assume we are a heating oil delivery service company that sells 100,000 gallons of heating oil every month its clients. The firm wants to hedge its position buy entering into a contract to buy its heating oil each month for the next 4 months. What would be the swap price of the 100,000 gallons of heating oil each month for the next 4-months if the following information is true? (Risk-free rate is provided per annum with continuous compounding) Month Forward Price Risk-Free Rate 1 $ 2.999 1.50% 2 $ 3.019 1.50% 1.60% 4 $ 1.75% 3 $ 3.039 3.075 3) Let's assume we are a heating oil delivery service company that sells 100,000 gallons of heating oil every month its clients. The firm wants to hedge its position buy entering into a contract to buy its heating oil each month for the next 4 months. What would be the swap price of the 100,000 gallons of heating oil each month for the next 4-months if the following information is true? (Risk-free rate is provided per annum with continuous compounding) Month Forward Price Risk-Free Rate 1 $ 2.999 1.50% 2 $ 3.019 1.50% 1.60% 4 $ 1.75% 3 $ 3.039 3.075

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts