Question: Please show the formula for CTA and Foreign Exchange gain (loss) Assume that the balance sheet and income statement of a French subsidiary, which keeps

Please show the formula for CTA and Foreign Exchange gain (loss)

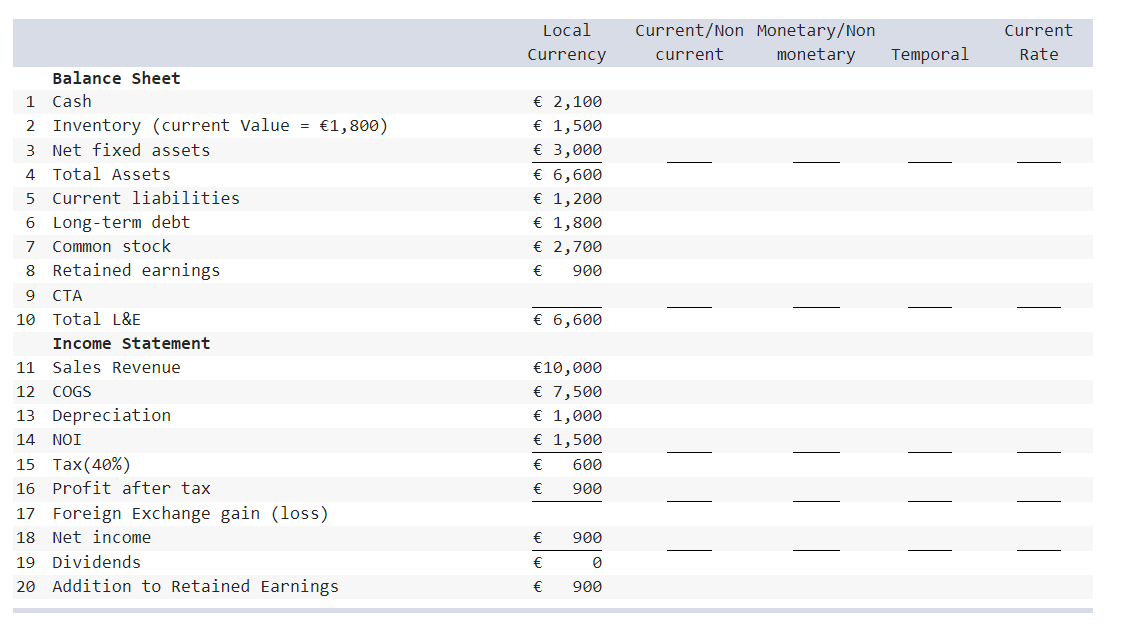

Assume that the balance sheet and income statement of a French subsidiary, which keeps its books in euro, is translated into U.S. dollars, the reporting currency of the U.S. MNC.

The table presents the balance sheet and income statement in euro.The subsidiary is at the end of its first year of operation.The historical exchange rate is $1.60/1.00 and the most recent exchange rate is $2.00/.

Fill out the 20 missing entries that translate the balance sheet and income statement for this French subsidiary using the Current/Noncurrent Method, the Monetary/Nonmonetary Method, the Temporal Method, and the Current Rate Method.

Local Currency Current/Non Monetary/Non current monetary Current Rate Temporal 4 2,100 1,500 3,000 6,600 1,200 1,800 2,700 900 6,600 Balance Sheet 1 Cash 2 Inventory (current Value = 1,800) 3 Net fixed assets Total Assets 5 Current liabilities 6 Long-term debt 7 Common stock 8 Retained earnings 9 CTA 10 Total L&E Income Statement 11 Sales Revenue 12 COGS 13 Depreciation 14 NOI 15 Tax(40%) 16 Profit after tax 17 Foreign Exchange gain (loss) 18 Net income 19 Dividends 20 Addition to retained Earnings 10,000 7,500 1,000 1,500 600 900 900 900

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts