Question: please show the formula in excel and solve the question in EXCEL thank you :) Even though most corporate bonds in the United States make

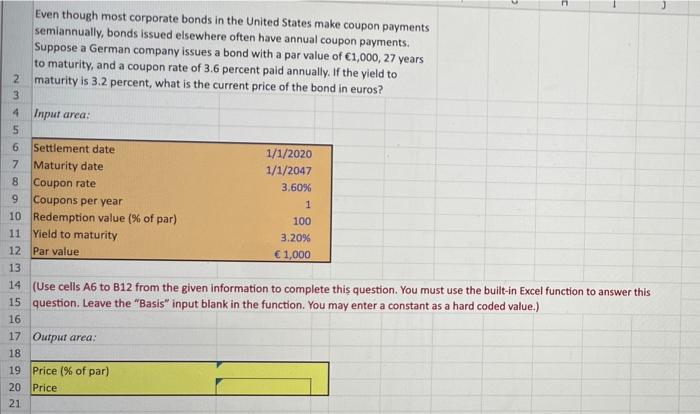

Even though most corporate bonds in the United States make coupon payments semiannually, bonds issued elsewhere often have annual coupon payments. Suppose a German company issues a bond with a par value of 1,000, 27 years to maturity, and a coupon rate of 3.6 percent paid annually. If the yield to maturity is 3.2 percent, what is the current price of the bond in euros? 2 3 4 Input area: 5 Settlement date 1/1/2020 7 Maturity date 1/1/2047 8 Coupon rate 3.60% 9 Coupons per year 1 10 Redemption value (% of par) 100 11 Yield to maturity 3.20% 12 Par value 1,000 13: 14 (Use cells A6 to B12 from the given information to complete this question. You must use the built-in Excel function to answer this 15 question. Leave the "Basis" input blank in the function. You may enter a constant as a hard coded value.) 16 17 Output area: 18 19 Price (% of par) 20 Price 21 67

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts