Question: please show the process Part A HPF Inc. is financed 80% by common stock and 20% by bonds. The expected return on the common stock

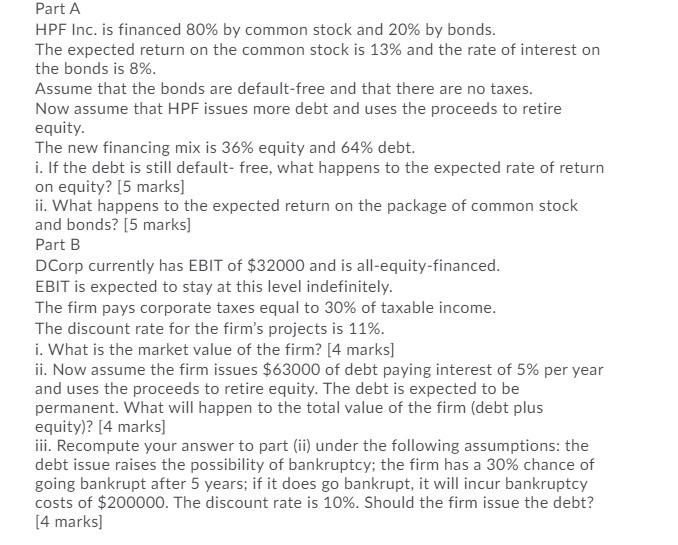

Part A HPF Inc. is financed 80% by common stock and 20% by bonds. The expected return on the common stock is 13% and the rate of interest on the bonds is 8%. Assume that the bonds are default-free and that there are no taxes. Now assume that HPF issues more debt and uses the proceeds to retire equity. The new financing mix is 36% equity and 64% debt. i. If the debt is still default-free, what happens to the expected rate of return on equity? [5 marks] ii. What happens to the expected return on the package of common stock and bonds? [5 marks] Part B DCorp currently has EBIT of $32000 and is all-equity-financed. EBIT is expected to stay at this level indefinitely. The firm pays corporate taxes equal to 30% of taxable income. The discount rate for the firm's projects is 11%. i. What is the market value of the firm? [4 marks] ii. Now assume the firm issues $63000 of debt paying interest of 5% per year and uses the proceeds to retire equity. The debt is expected to be permanent. What will happen to the total value of the firm (debt plus equity)? [4 marks) iii. Recompute your answer to part (ii) under the following assumptions: the debt issue raises the possibility of bankruptcy; the firm has a 30% chance of going bankrupt after 5 years; if it does go bankrupt, it will incur bankruptcy costs of $200000. The discount rate is 10%. Should the firm issue the debt? [4 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts