Question: Please show the same exact formate of answer sort for (b) Current Attempt in Progress The unadjusted trial balance for Carla Vista Engineering at its

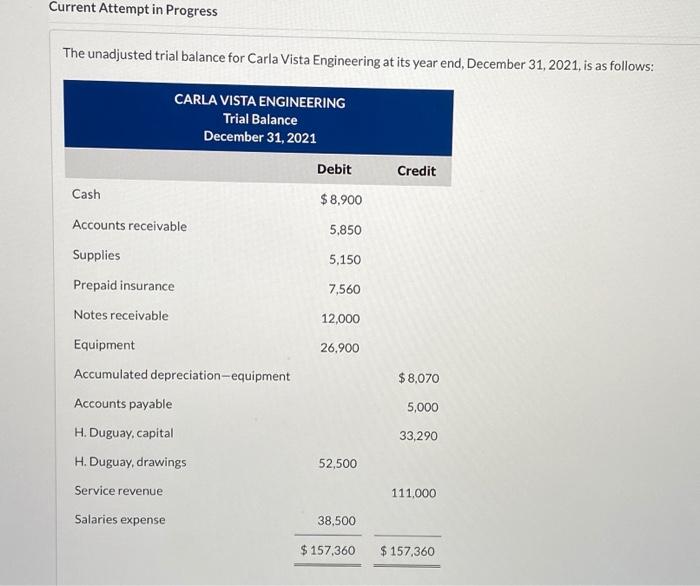

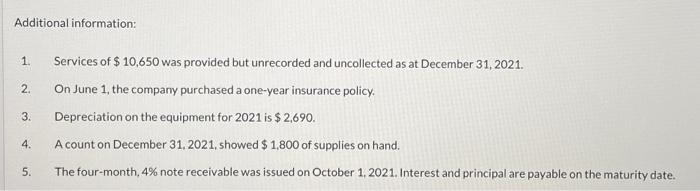

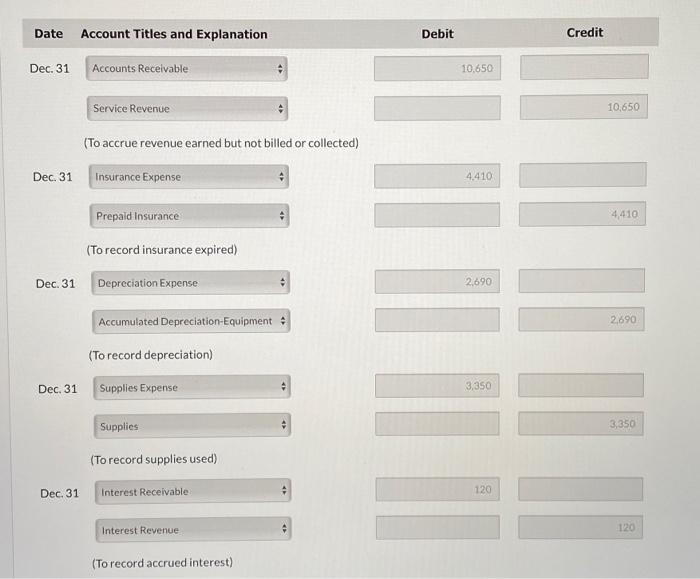

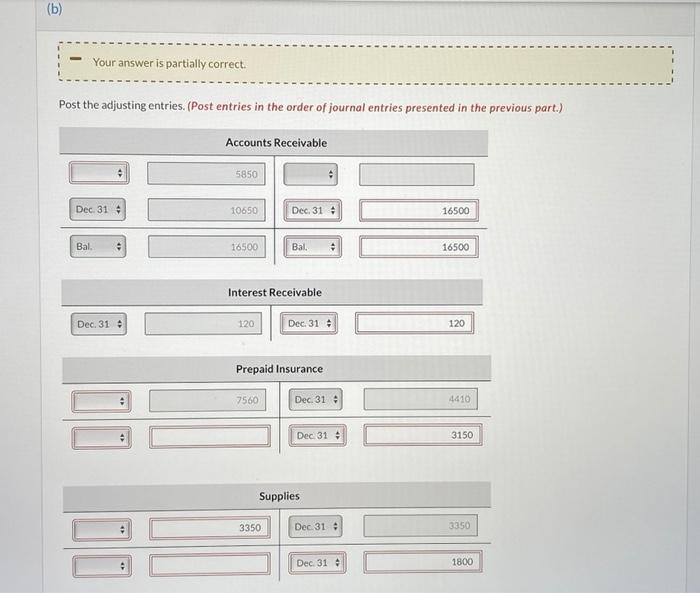

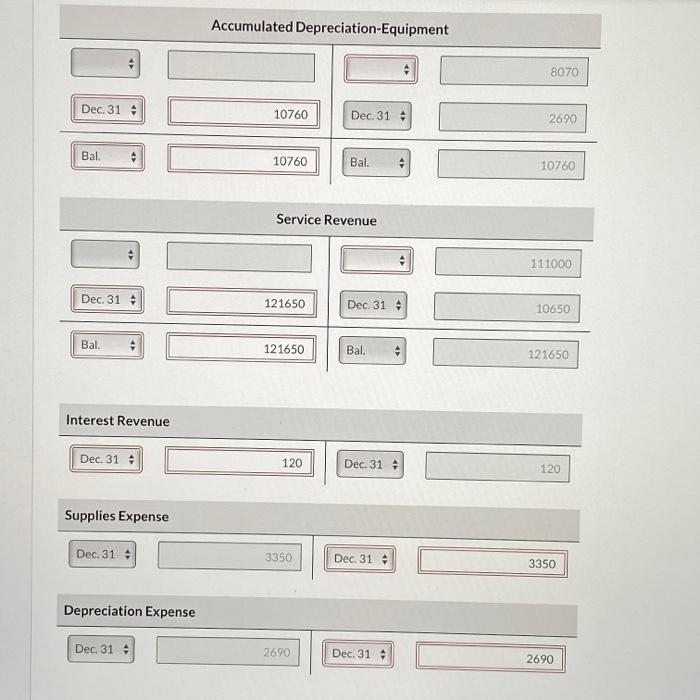

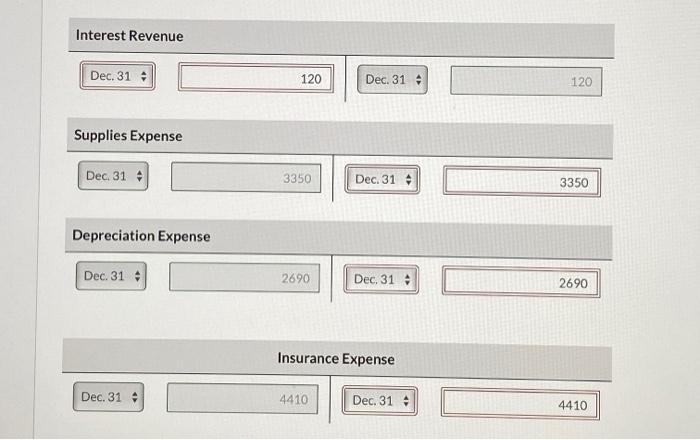

Current Attempt in Progress The unadjusted trial balance for Carla Vista Engineering at its year end, December 31, 2021, is as follows: CARLA VISTA ENGINEERING Trial Balance December 31, 2021 Debit Credit Cash $8.900 Accounts receivable 5,850 Supplies 5,150 7.560 12,000 Prepaid insurance Notes receivable Equipment Accumulated depreciation-equipment Accounts payable 26,900 $ 8,070 5,000 H. Duguay, capital 33,290 H. Duguay, drawings 52,500 Service revenue 111,000 Salaries expense 38,500 $157,360 $157,360 Additional information: 1. 2. 3. Services of $ 10,650 was provided but unrecorded and uncollected as at December 31, 2021. On June 1, the company purchased a one-year insurance policy, Depreciation on the equipment for 2021 is $ 2,690. A count on December 31, 2021, showed $ 1.800 of supplies on hand. The four-month, 4% note receivable was issued on October 1, 2021. Interest and principal are payable on the maturity date. 4 4. 5. Date Account Titles and Explanation Debit Credit Dec. 31 Accounts Receivable 10,650 Service Revenue 10,650 (To accrue revenue earned but not billed or collected) Dec. 31 Insurance Expense 4.410 Prepaid Insurance 4,410 (To record insurance expired) Depreciation Expense Dec. 31 2,690 UUTEE Accumulated Depreciation Equipment : 2.690 (To record depreciation) Dec. 31 Supplies Expense 3,350 Supplies 3,350 TH (To record supplies used) 120 Dec. 31 Interest Receivable Interest Revenue 120 (To record accrued interest) (b) Your answer is partially correct. Post the adjusting entries. (Post entries in the order of journal entries presented in the previous part.) Accounts Receivable 5850 Dec 31 4 10650 Dec 31 16500 Bal 16500 Bal. + 16500 Interest Receivable Dec. 31 120 Dec. 31 120 Prepaid Insurance 7560 Dec. 31 4410 Dec 31 : 3150 Supplies 3350 Dec 31 3350 Dec 31 1800 Accumulated Depreciation-Equipment 8070 Dec. 31 10760 Dec. 31 2690 Bal. 10760 Bal. 10760 Service Revenue 111000 Dec. 31 121650 Dec 31 10650 Bal. 121650 Bal. 121650 Interest Revenue Dec. 31 120 Dec. 31 120 Supplies Expense Dec 31 3350 Dec. 31 3350 Depreciation Expense Dec. 31 2690 Dec. 31 4 2690 Interest Revenue Dec. 31 120 Dec. 31 120 Supplies Expense Dec 31 4 3350 Dec. 31 3350 Depreciation Expense Dec 31 4 2690 Dec 31 4 2690 Insurance Expense Dec. 31 4410 Dec. 31 4410

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts