Question: PLEASE SHOW THE SOLUTION STEP BY STEP CLEARLY A. Figure 3.1 ghows a cash flow diagram for an engineering project. The project has an initial

PLEASE SHOW THE SOLUTION STEP BY STEP CLEARLY

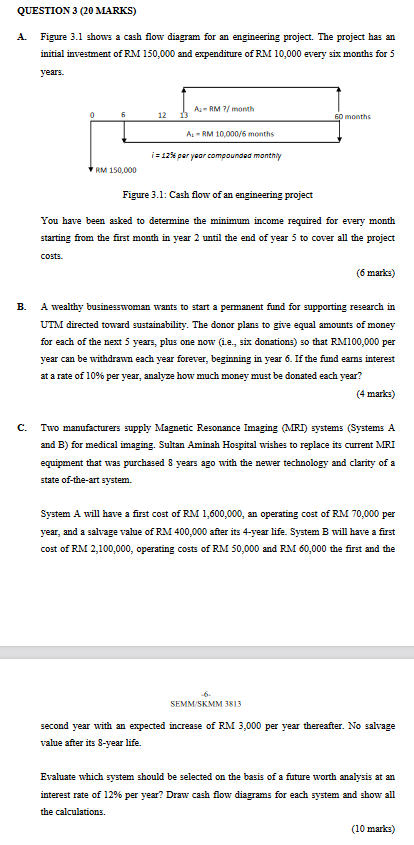

A. Figure 3.1 ghows a cash flow diagram for an engineering project. The project has an initial investment of RM 150,000 and expenditure of RM 10,000 every gix months for 5 years. Figure 3.1: Cash flow of an engineering project You have been aaked to determine the minimum income required for every month starting from the first month in year 2 until the end of year 5 to cover all the project costs. (6 marks) B. A wealthy businesswoman wants to start a permanent fund for supporting research in UTM directed toward gustainability. The donor plans to give equal amounts of money for each of the next 5 years, plus one now (i.e., six donations) so that RM100,000 per year can be withdrawn each year forever, beginning in year 6 . If the fund earns interest at a rate of 10% per year, analyze how much money must be donated each year? (4 marks) C. Two manufacturers supply Magnetic Resonance Imaging (MRI) systems (Systems A and B) for medical imaging. Sultan Aminah Hospital wishes to replace its current MRI equipment that was purchased 8 years ago with the newer technology and clarity of a state of-the-art system. System A will have a first cost of RM 1,600,000, an operating cost of RM 70,000 per year, and a salvage value of RM 400,000 after its 4-year life. System B will have a first cost of RM 2,100,000, operating costs of RM 50,000 and RM 60,000 the first and the SEMM/SKMM 3813 second year with an expected increase of RM 3,000 per year thereafter. No salvage value after its 8-year life. Evaluate which system should be selected on the basis of a future worth analysis at an interest rate of 12% per year? Draw cash flow diagrams for each system and show all the calculations. (10 marks) A. Figure 3.1 ghows a cash flow diagram for an engineering project. The project has an initial investment of RM 150,000 and expenditure of RM 10,000 every gix months for 5 years. Figure 3.1: Cash flow of an engineering project You have been aaked to determine the minimum income required for every month starting from the first month in year 2 until the end of year 5 to cover all the project costs. (6 marks) B. A wealthy businesswoman wants to start a permanent fund for supporting research in UTM directed toward gustainability. The donor plans to give equal amounts of money for each of the next 5 years, plus one now (i.e., six donations) so that RM100,000 per year can be withdrawn each year forever, beginning in year 6 . If the fund earns interest at a rate of 10% per year, analyze how much money must be donated each year? (4 marks) C. Two manufacturers supply Magnetic Resonance Imaging (MRI) systems (Systems A and B) for medical imaging. Sultan Aminah Hospital wishes to replace its current MRI equipment that was purchased 8 years ago with the newer technology and clarity of a state of-the-art system. System A will have a first cost of RM 1,600,000, an operating cost of RM 70,000 per year, and a salvage value of RM 400,000 after its 4-year life. System B will have a first cost of RM 2,100,000, operating costs of RM 50,000 and RM 60,000 the first and the SEMM/SKMM 3813 second year with an expected increase of RM 3,000 per year thereafter. No salvage value after its 8-year life. Evaluate which system should be selected on the basis of a future worth analysis at an interest rate of 12% per year? Draw cash flow diagrams for each system and show all the calculations. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts