Question: Please show the solution with all formulas and calculations step by step. Do not use exel please. The joint stock company has a total capital

Please show the solution with all formulas and calculations step by step. Do not use exel please.

Please show the solution with all formulas and calculations step by step. Do not use exel please.

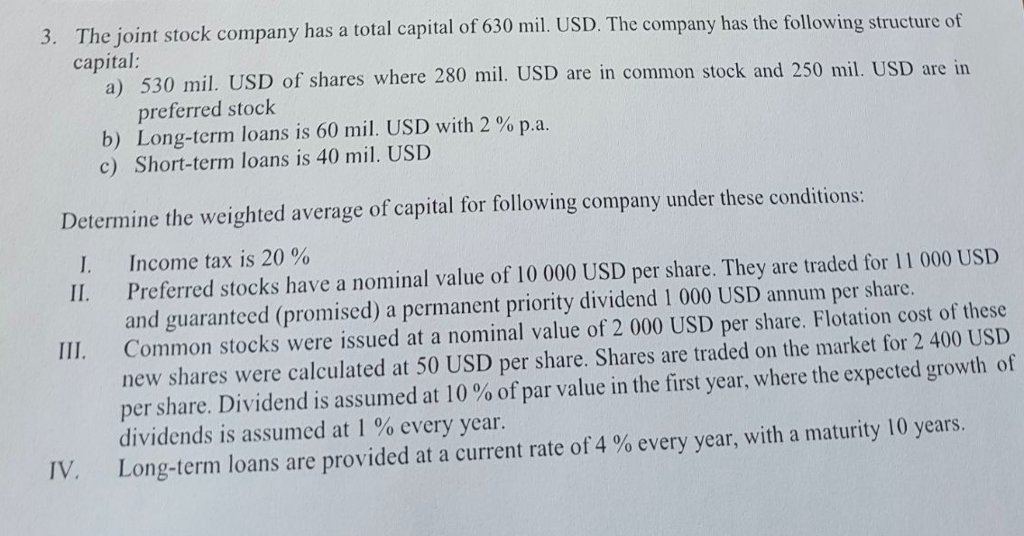

The joint stock company has a total capital of 630 mil. USD. The company has the following structure of capital: 3. a) 530 mil. USD of shares where 280 mil. USD are in common stock and 250 mil. USD are in preferred stock b) Long-term loans is 60 mil. USD with 2 % p.a c) Short-term loans is 40 mil. USD Determine the weighted average of capital for following company under these conditions: Income tax is 20 % Preferred stocks have a nominal value of 10 000 USD per share. They are traded for 11 000 USD and guaranteed (promised) a permanent priority dividend 1 000 USD annum per share. Common stocks were issued at a nominal value of 2 000 USD per share. Flotation cost of these new shares were calculated at 50 USD per share. Shares are traded on the market for 2 400 USD pers are. Dividend is assumed at 10 % of par value in the first year, where the expected growth of dividends is assumed at 1 % every year. Long-term loans are provided at a current rate of 4 % every year, with a maturity 10 years. II. III. IV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts