Question: Please show the specific progress and formula. The Capital Asset Pricing Model (CAPM) is a model used to compute returns (expected returns) for different assets.

Please show the specific progress and formula.

Please show the specific progress and formula.

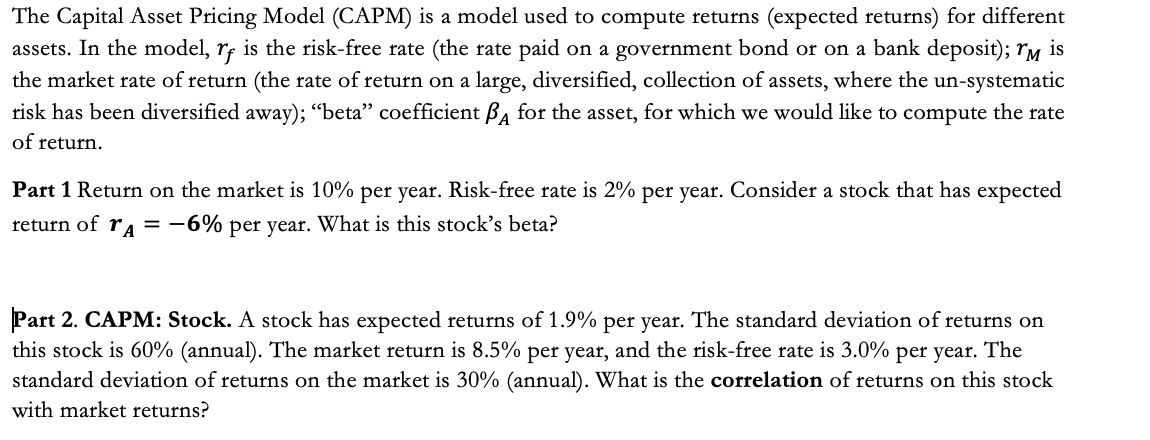

The Capital Asset Pricing Model (CAPM) is a model used to compute returns (expected returns) for different assets. In the model, rf is the risk-free rate (the rate paid on a government bond or on a bank deposit); rm is the market rate of return (the rate of return on a large, diversified, collection of assets, where the un-systematic risk has been diversified away); beta coefficient BA for the asset, for which we would like to compute the rate of return. Part 1 Return on the market is 10% per year. Risk-free rate is 2% per year. Consider a stock that has expected return of ra = -6% per year. What is this stock's beta? Part 2. CAPM: Stock. A stock has expected returns of 1.9% per year. The standard deviation of returns on this stock is 60% (annual). The market return is 8.5% per year, and the risk-free rate is 3.0% per year. The standard deviation of returns on the market is 30% (annual). What is the correlation of returns on this stock with market returns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts