Question: Please show the step-by-step calculations in excel format. Thank you On 1 May, 2021, Daydream, Ltd. has a capital structure, as follow. 1. Bank loan

Please show the step-by-step calculations in excel format. Thank you

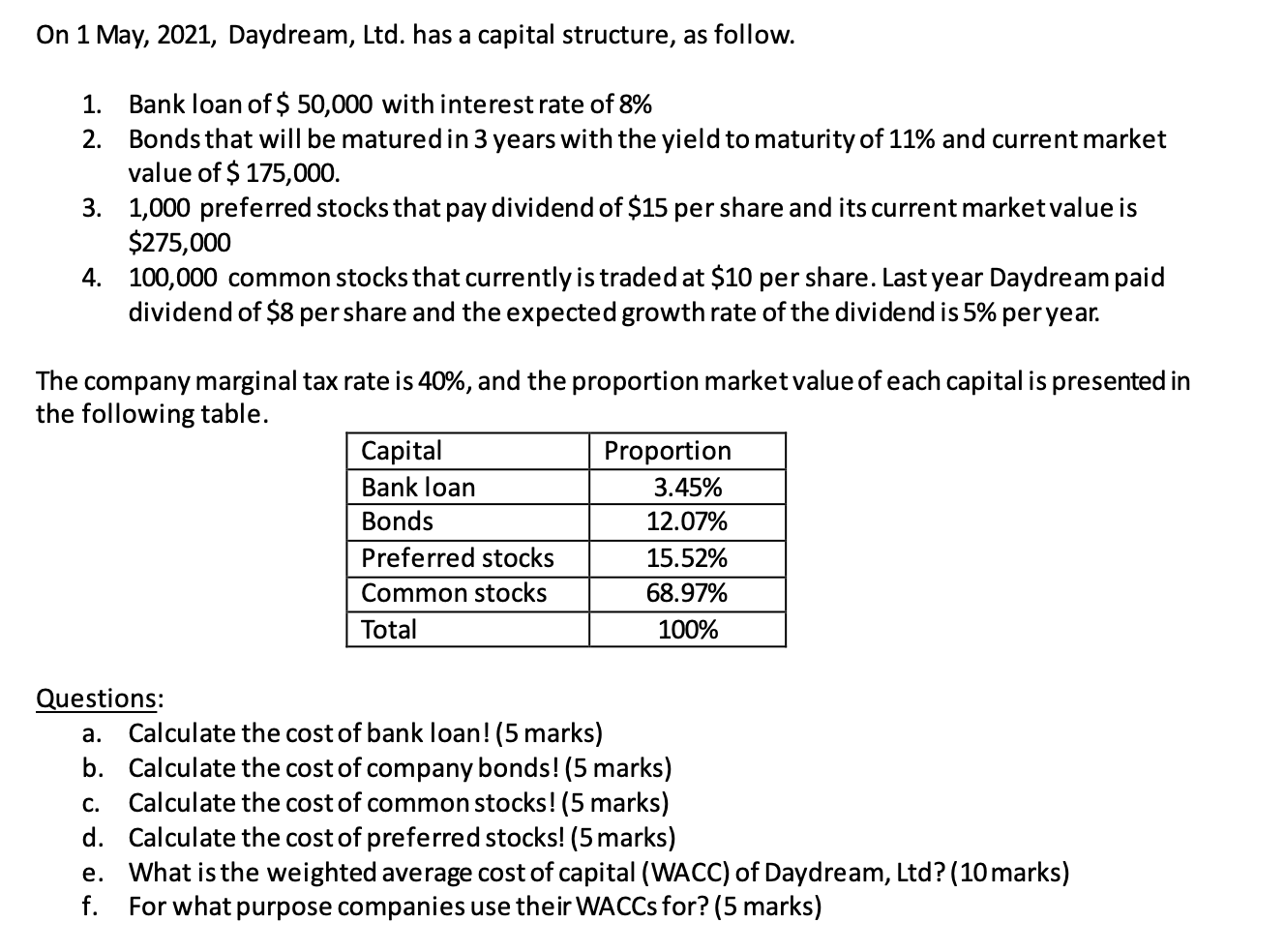

On 1 May, 2021, Daydream, Ltd. has a capital structure, as follow. 1. Bank loan of $ 50,000 with interest rate of 8% 2. Bonds that will be matured in 3 years with the yield to maturity of 11% and current market value of $ 175,000. 3. 1,000 preferred stocks that pay dividend of $15 per share and its current market value is $275,000 4. 100,000 common stocks that currently is traded at $10 per share. Last year Daydream paid dividend of $8 per share and the expected growth rate of the dividend is 5% per year. The company marginal tax rate is 40%, and the proportion market value of each capital is presented in the following table. Capital Proportion Bank loan 3.45% Bonds 12.07% Preferred stocks 15.52% Common stocks 68.97% Total 100% Questions: a. Calculate the cost of bank loan! (5 marks) b. Calculate the cost of company bonds!(5 marks) C. Calculate the cost of common stocks! (5 marks) d. Calculate the cost of preferred stocks! (5 marks) What is the weighted average cost of capital (WACC) of Daydream, Ltd? (10 marks) f. For what purpose companies use their WACCs for? (5 marks) e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts