Question: Please show the steps. 1) (2 points) Suppose that the bond being delivered in the Treasury Bond futures contract has a remaining maturity of 15

Please show the steps.

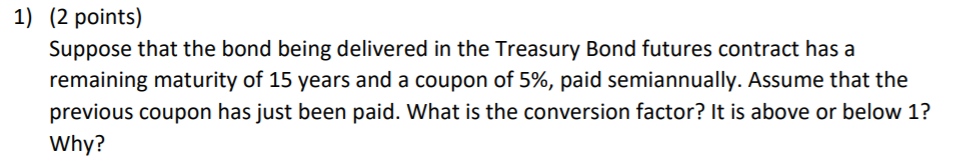

1) (2 points) Suppose that the bond being delivered in the Treasury Bond futures contract has a remaining maturity of 15 years and a coupon of 5%, paid semiannually. Assume that the previous coupon has just been paid. What is the conversion factor? It is above or below 1? Why? 1) (2 points) Suppose that the bond being delivered in the Treasury Bond futures contract has a remaining maturity of 15 years and a coupon of 5%, paid semiannually. Assume that the previous coupon has just been paid. What is the conversion factor? It is above or below 1? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts