Question: PLEASE show the steps a) A $ 200 000 loan is made with 30 years maturity and monthly compounded. The loan is based on a

PLEASE show the steps

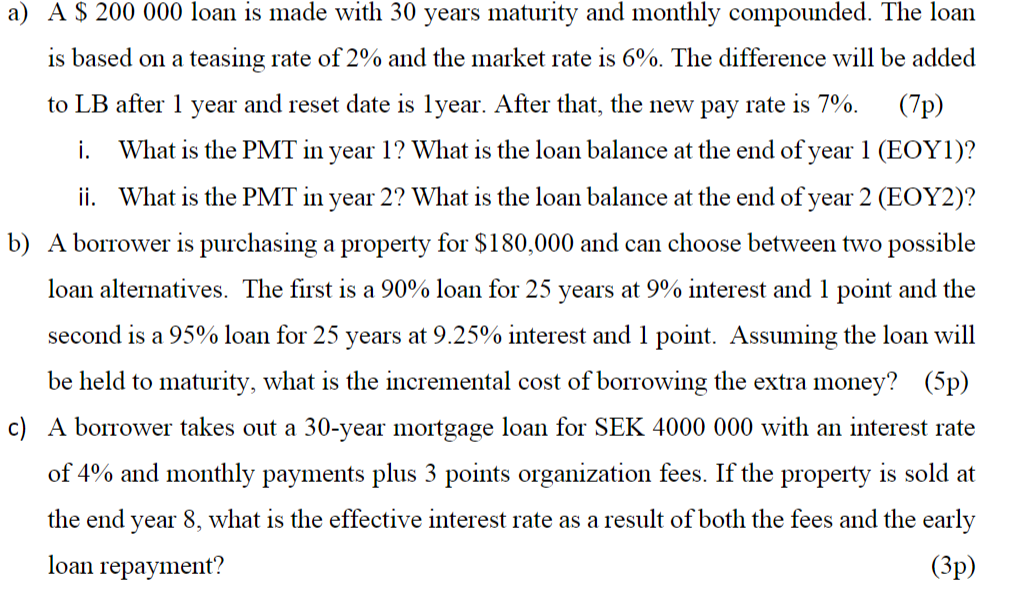

a) A $ 200 000 loan is made with 30 years maturity and monthly compounded. The loan is based on a teasing rate of 2% and the market rate is 6%. The difference will be added to LB after 1 year and reset date is lyear. After that, the new pay rate is 7%. (7) i. What is the PMT in year 1? What is the loan balance at the end of year 1 (EOY1)? ii. What is the PMT in year 2? What is the loan balance at the end of year 2 (EOY2)? b) A borrower is purchasing a property for $180,000 and can choose between two possible loan alternatives. The first is a 90% loan for 25 years at 9% interest and 1 point and the second is a 95% loan for 25 years at 9.25% interest and 1 point. Assuming the loan will be held to maturity, what is the incremental cost of borrowing the extra money? (5p) c) A borrower takes out a 30-year mortgage loan for SEK 4000 000 with an interest rate of 4% and monthly payments plus 3 points organization fees. If the property is sold at the end year 8, what is the effective interest rate as a result of both the fees and the early loan repayment? (3p)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts