Question: Please show the steps and formulas they used to solve part b) This is the solution for part b) (Show the steps of how they

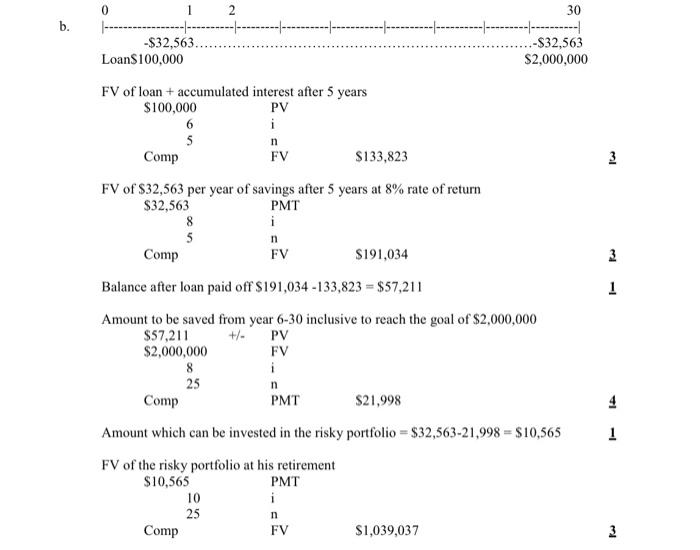

QUESTION 2: Mr. MoneyMiser is planning to retire in 30 years. His current net worth is $100,000 (it is a loan at an interest rate of 6% per annum) His goal is to have $2,000,000 at retirement. a. Determine the constant amount he should be saving each year for 30 years, so that his loan is paid off and he will have $2,000,000 for his retirement. He will earn 6% per year rate of return on his savings. b. MoneyMiser will save the same annual amount as calculated in part a above, but suppose he can earn 8% per annum on his savings. Loan and all the accumulated interest at the rate of 6% will be paid off 5 years from today. After paying off the loan how much MoneyMiser should be saving each year to have $2,000,000 at his retirement. Any difference between his savings in part a above, and required savings per year in part b to achieve his goal of $2,000, 000 at retirement will be invested in a risky portfolio expected to earn 10% per year. What will be the value of the risky portfolio when he retires. FV of loan + accumulated interest after 5 veare FV of $32,563 per year of savings after 5 years at 8% rate of return Balance after loan paid off $191,034133,823=$57,211 Amount to be saved from year 630 inclusive to reach the goal of $2,000,000 Amount which can be invested in the risky portfolio =$32,56321,998=$10,565

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts