Question: Please show the steps for why these are correct. Problem 18-41 (LO. 1, 2) Rasa and Jane form Osprey Corporation. Rasa transfers property (basis of

Please show the steps for why these are correct.

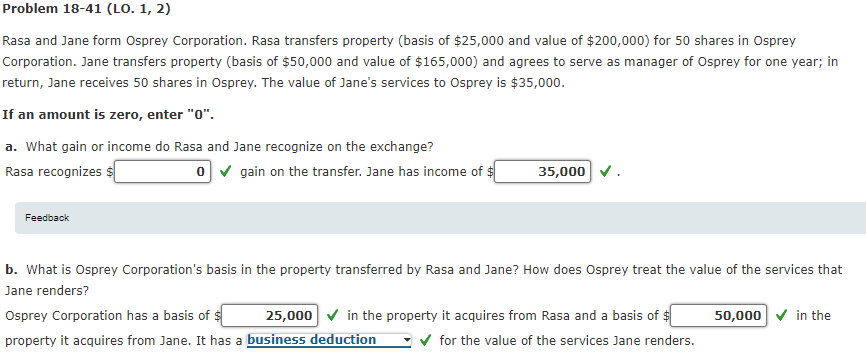

Problem 18-41 (LO. 1, 2) Rasa and Jane form Osprey Corporation. Rasa transfers property (basis of $25,000 and value of $200,000) for 50 shares in Osprey Corporation. Jane transfers property (basis of $50,000 and value of $165,000) and agrees to serve as manager of Osprey for one year; in return, Jane receives 50 shares in Osprey. The value of Jane's services to Osprey is $35,000. If an amount is zero, enter "0". a. What gain or income do Rasa and Jane recognize on the exchange? Rasa recognizes $ o gain on the transfer. Jane has income of $ 35,000 Feedback b. What is Osprey Corporation's basis in the property transferred by Rasa and Jane? How does Osprey treat the value of the services that Jane renders? Osprey Corporation has a basis of $ 25,000 in the property it acquires from Rasa and a basis of $ 50,000 in the property it acquires from Jane. It has a business deduction for the value of the services Jane renders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts