Question: Please show the steps in order to get these given answers 7. The following provides the basis for performing a valuation using the adjusted present

Please show the steps in order to get these given answers

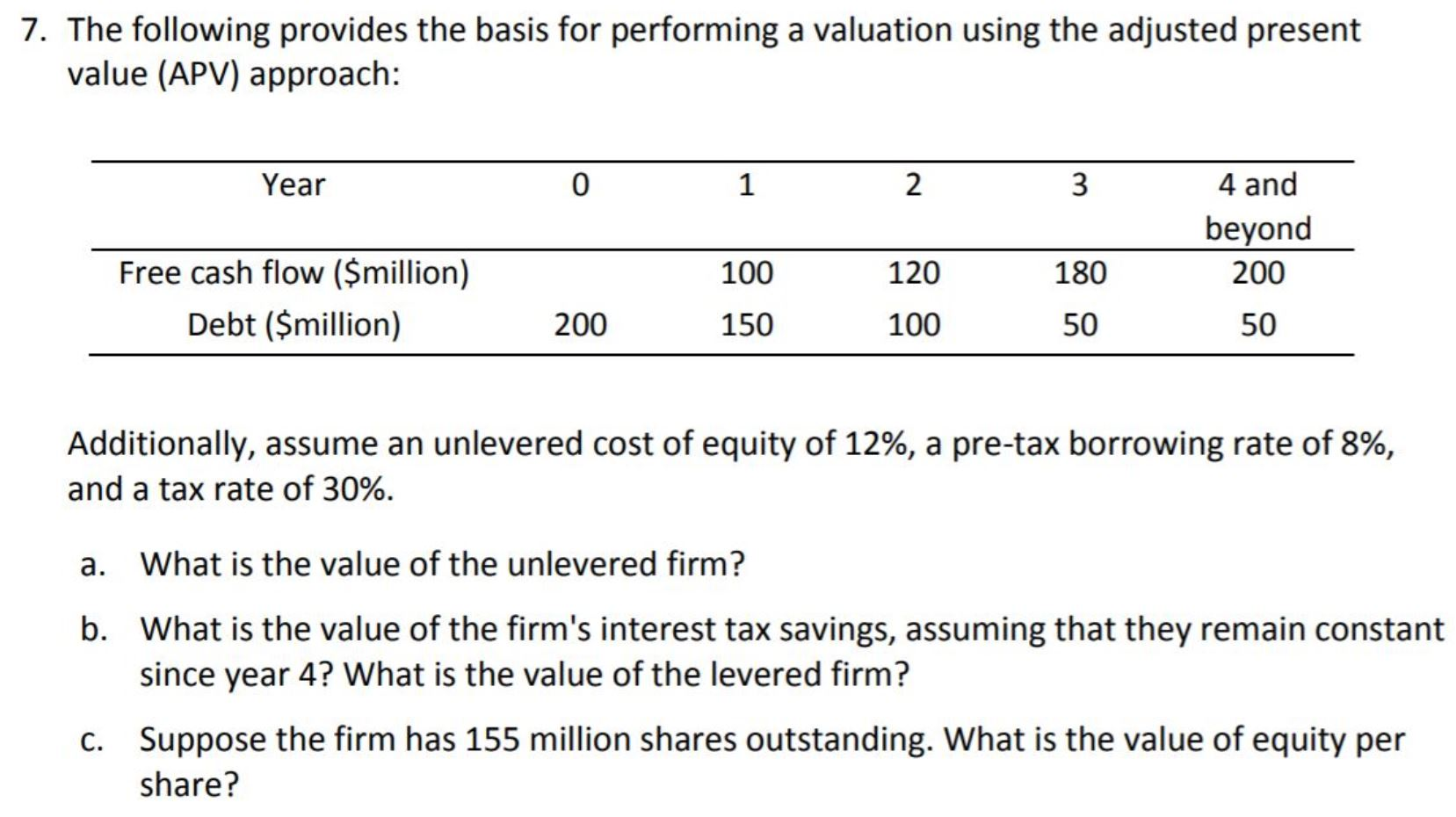

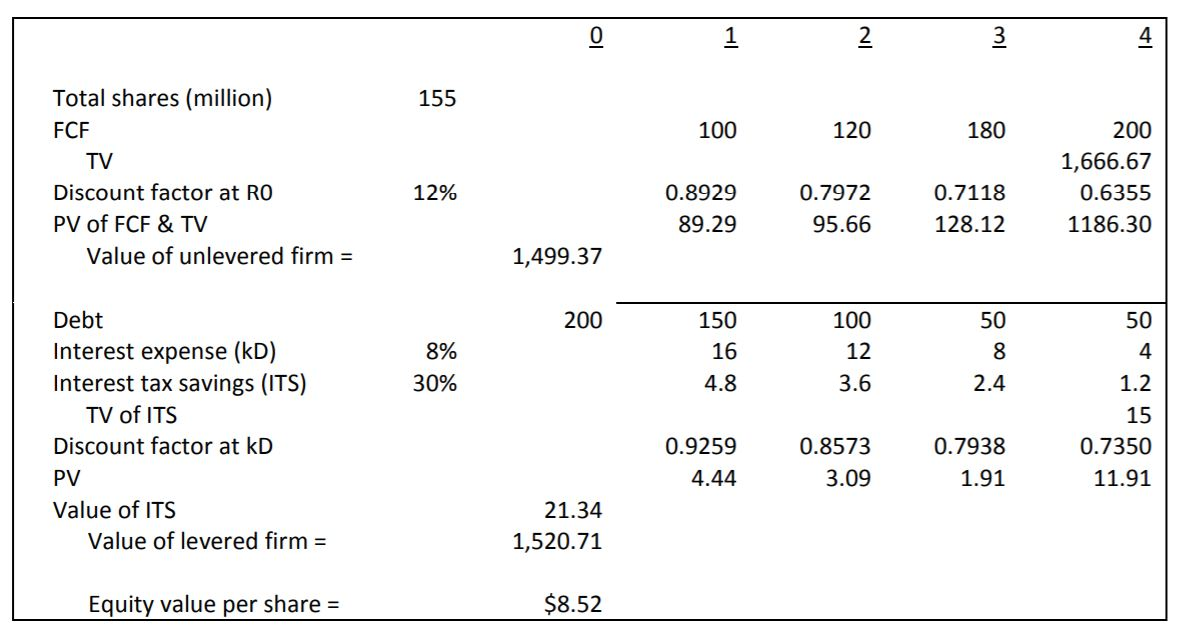

7. The following provides the basis for performing a valuation using the adjusted present value (APV) approach: 0 2 Year 4 and beyond Free cash flow ($million) 120 200 100 180 Debt ($million) 50 150 100 200 50 Additionally, assume an unlevered cost of equity of 12%, a pre-tax borrowing rate of 8%, and a tax rate of 30% What is the value of the unlevered firm? a. What is the value of the firm's interest tax savings, assuming that they remain constant since year 4? What is the value of the levered firm? b. Suppose the firm has 155 million shares outstanding. What is the value of equity per c. share? 2 4 Total shares (million) 155 100 120 180 200 FCF TV 1,666.67 Discount factor at RO 12% 0.8929 0.7972 0.7118 0.6355 PV of FCF & TV 89.29 95.66 128.12 1186.30 Value of unlevered firm 1,499.37 200 Debt 150 100 50 50 Interest expense (kD) Interest tax savings (ITS) 8% 16 12 8 4 30% 4.8 3.6 2.4 1.2 TV of ITS 15 Discount factor at kD 0.7350 0.9259 0.8573 0.7938 3.09 1.91 PV 4.44 11.91 Value of ITS 21.34 Value of levered firm 1,520.71 $8.52 Equity value per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts