Question: Please show the steps on how to complete this problem. All steps and no use of excel all hand work. i need to know how

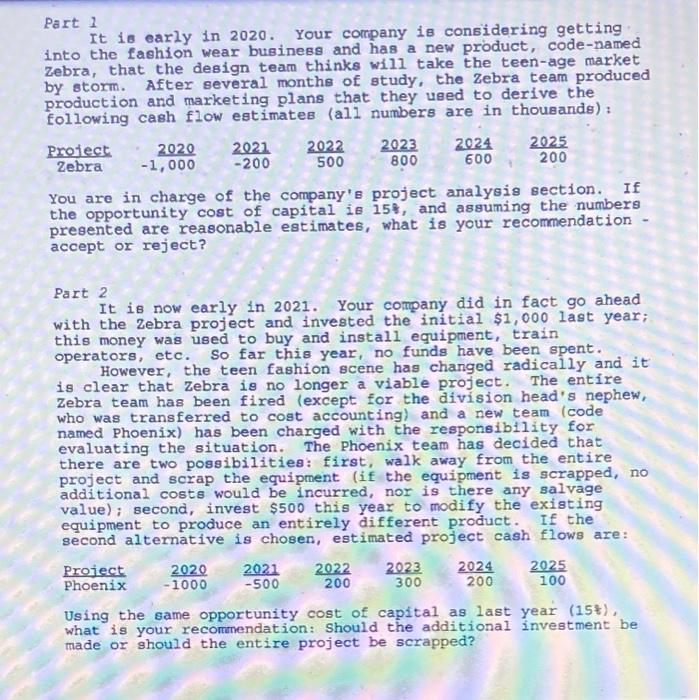

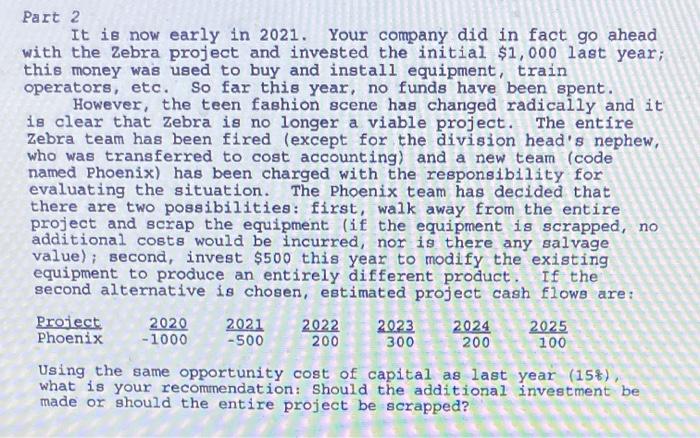

Part 2 It is early in 2020. Your company is considering getting into the fashion wear business and has a new product, code-named Zebra, that the design team thinks will take the teen-age market by storm. After several months of study, the Zebra team produced production and marketing plans that they used to derive the following cash flow estimates (all numbers are in thousands): Proiect 2020 2021 2022 2023 2024 2025 Zebra -1,000 -200 500 800 600 200 You are in charge of the company's project analysis section. If the opportunity cost of capital is 158, and assuming the numbers presented are reasonable estimates, what is your recommendation accept or reject? Part 2 It is now early in 2021. Your company did in fact go ahead with the Zebra project and invested the initial $1,000 last year; this money was used to buy and install equipment, train operators, etc. So far this year, no funds have been spent. However, the teen fashion scene has changed radically and it is clear that Zebra is no longer a viable project. The entire Zebra team has been fired (except for the division head's nephew, who was transferred to cost accounting) and a new team (code named Phoenix) has been charged with the responsibility for evaluating the situation. The Phoenix team has decided that there are two possibilities: first, walk away from the entire project and scrap the equipment (if the equipment is scrapped, no additional costs would be incurred, nor is there any salvage value); second, invest $500 this year to modify the existing equipment to produce an entirely different product. If the second alternative is chosen, estimated project cash flows are: Project 2020 2021 2022 2023 2024 2025 Phoenix -1000 -500 200 300 200 100 Using the same opportunity cost of capital as last year (15+), what is your recommendation: Should the additional investment be made or should the entire project be scrapped? Part 2 It is now early in 2021. Your company did in fact go ahead with the Zebra project and invested the initial $1,000 last year; this money was used to buy and install equipment, train operators, etc. So far this year, no funds have been spent. However, the teen fashion scene has changed radically and it is clear that Zebra is no longer a viable project. The entire Zebra team has been fired (except for the division head's nephew, who was transferred to cost accounting) and a new team (code named Phoenix) has been charged with the responsibility for evaluating the situation. The Phoenix team has decided that there are two possibilities: first, walk away from the entire project and scrap the equipment (if the equipment is scrapped, no additional costs would be incurred, nor is there any salvage value); second, invest $500 this year to modify the existing equipment to produce an entirely different product. If the second alternative is chosen, estimated project cash flows are: Project 2020 2021 2022 2023 2024 2025 Phoenix -1000 -500 200 300 200 100 Using the same opportunity cost of capital as last year (15%) what is your recommendation: Should the additional investment be made or should the entire project be scrapped

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts