Question: Please show the steps so I can learn how you did it. Comprehensive income items Marketable securities on the balance sheet at a cost of

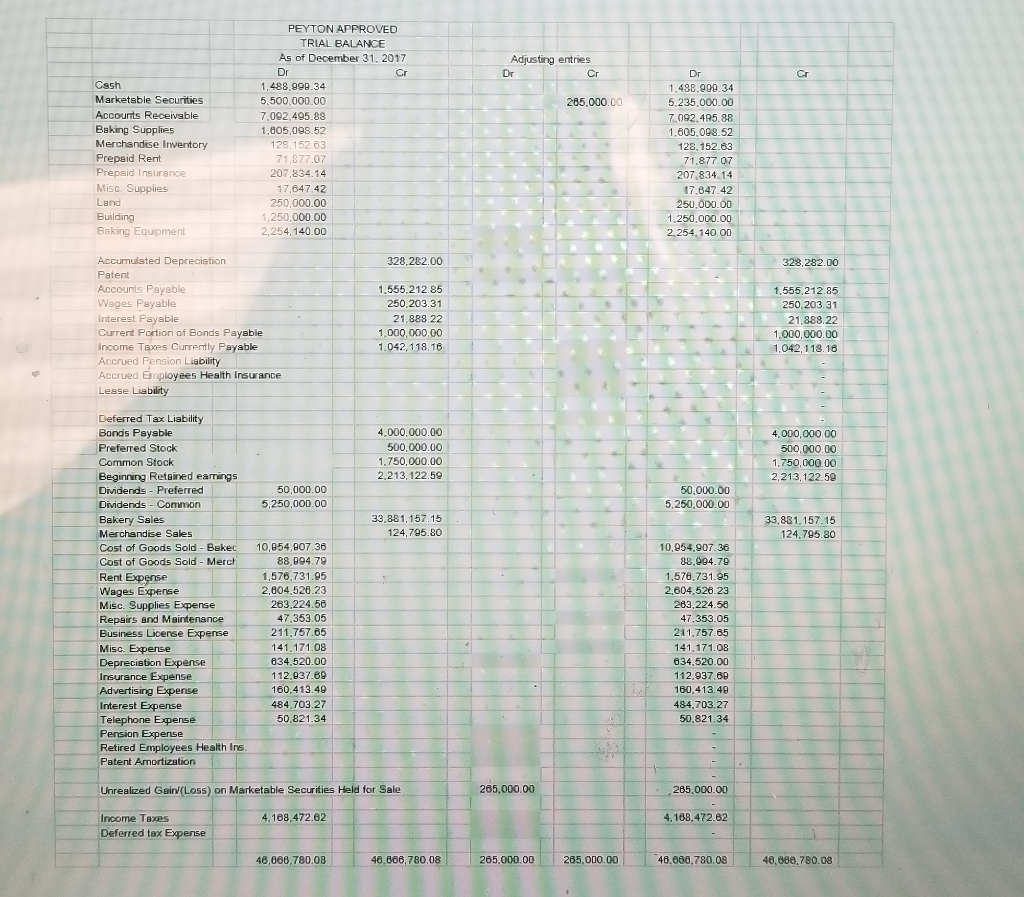

| Please show the steps so I can learn how you did it. Comprehensive income items Marketable securities on the balance sheet at a cost of $5,500,000 are available-for-sale. Market value at the balance sheet date is $5,235,00. Prepare the adjusting entry to record the unrealized loss and include in comprehensive income Tax information and implications $1,500 in meal and entertainment expenses show as a permanent difference for tax. Prepare the necessary adjusting entry. The company uses straight line depreciation for book and MACRS depreciation for the tax return MACRS depreciation was $209,301 higher than book. Prepare the adjusting entry for the deferred tax. There have been recent tax structure changes the could impact the company. Peyton Approved has been a C Corp since the beginning of these changes. Peyton provides for taxes at 25% of pretax income (20% Federal, 5% state)

| ||||||||||||

PEYTON APPROVED TRIAL BALANCE As of December 31, 2017 Adjusting entries Dr Dr Cr Cr Dr Cr 1,488,999.34 5.500,000.00 7.092,495.88 1,805,098.52 128,152.63 1.498.990.34 5,235,000.00 Marketable Securties Accounts Receivable 285,000.00 7.092.495.88 1.605.098.52 128.152.63 71.877.07 207 834 14 17.847.42 250.000.00 lies Merchandise Inventory Prepeid Rent Prepsid Insurance Misc Supplies 207,834.14 17,647.42 250,000.00 1,250,000.00 2,254,140.00 000. Beking Equipment 2,254, 140.00 Accumuated Deprecistion 328.282.00 328,282.00 1.555.212.85 Accounts Paysble Wages Payable interest Paysble Current Portion of Bonds Payable Income Taxes Currently Payable 1.555,212.85 250,203.31 21,888.22 1,000,000 .00 250,203.31 21,888.22 1,000,000.00 Accrued Enmployees Health Insurance Lesse Liability Deferred Tax Liability Bonds Payable 4.000,000.00 500,000.00 1.750,000.00 2,213,122.59 4,000,000.00 500,000.00 2.213,122.59 Stock Beginning Retained eamings Dividends Preferred Dividends Common Bakery Sales Merchandise Sales 50,000.00 5,250,000.00 50,000.00 5,250,000.00 33,881,157.15 124,795.80 33,881.157.15 124.795.80 Cost of Goods Sold - Bekec 10,954,907.36 Cost of Goods Sold - Merct 88,994.79 1,576,731.95 2,604,526.23 10,954,907.36 88,994.79 1,570.731.95 2,604,528.23 283.224.58 47,353.05 211.757.65 Misc. Supplies Expense Repeirs and Msintenance 263.224.5 47.353.05 211.757.85 141.171.08 634.520.00 12,937.69 160.413.49 484,703.27 50,821.34 Misc. Expense Deprecistion Expense 634.520.00 112,937.69 1 Adverti sing 484,703.27 50,821.34 Telephone Expense Retired Employees Health Ins Patent Amortization Unrealized Gain(Loss) on Marketable Securities Held for Sale 285,000.00 265.000.O0 Income Taxes Deferred tex Epense 4,188,472.62 4.168,472.82 48,666.780.08 46,868, 780,08 265,000.00 265,000.00 48,606,780.08 40,800,780.08

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts