Question: Please show the steps, thanks. A bond maturing in five years with a face value of $100,000 is currently trading at $70, 636. If the

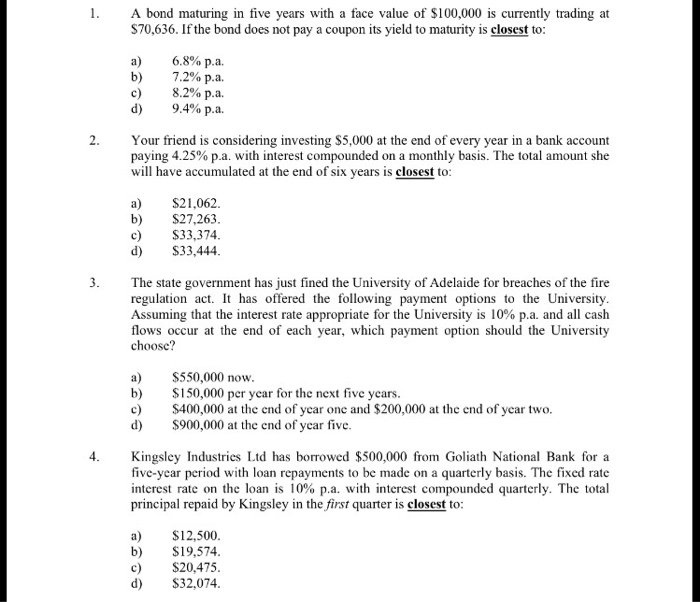

A bond maturing in five years with a face value of $100,000 is currently trading at $70, 636. If the bond does not pay a coupon its yield to maturity is closest to: 6.8% p.a. 7.2% p.a. 8.2% p.a. 9.4% p.a. Your friend is considering investing $5,000 at the end of every year in a bank account paying 4.25% p.a. with interest compounded on a monthly basis. The total amount she will have accumulated at the end of six years is closest to: $21, 062. $27, 263. $33, 374. $33, 444. The state government has just fined the University of Adelaide for breaches of the fire regulation act. It has offered the following payment options to the University. Assuming that the interest rate appropriate for the University is 10% p.a. and all cash flows occur at the end of each year, which payment option should the University choose? $550,000 now. $150,000 per year for the next five years. $400,000 at the end of year one and $200,000 at the end of year two. $900,000 at the end of year five. Kingsley Industries Ltd has borrowed $500,000 from Goliath National Bank for a five-year period with loan repayments to be made on a quarterly basis. The fixed rate interest rate on the loan is 10% p.a. with interest compounded quarterly. The total principal repaid by Kingsley in the first quarter is closest to: $12, 500. $19, 574. $20, 475. $32, 074

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts