Question: Please show the steps to finding the answer using a *Financial Calculator*! Thank you. 8) Crout Company has outstanding perpetual bonds that pay annual coupon

Please show the steps to finding the answer using a *Financial Calculator*! Thank you.

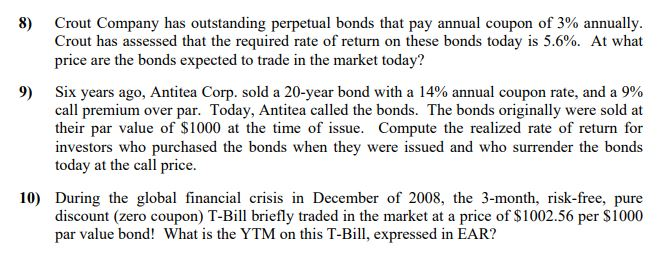

8) Crout Company has outstanding perpetual bonds that pay annual coupon of 3% annually. Crout has assessed that the required rate of return on these bonds today is 5.6%. At what price are the bonds expected to trade in the market today? 9) Six years ago, Antitea Corp. sold a 20-year bond with a 14% annual coupon rate, and a 9% call premium over par. Today, Antitea called the bonds. The bonds originally were sold at their par value of $1000 at the time of issue. Compute the realized rate of return for investors who purchased the bonds when they were issued and who surrender the bonds today at the call price. 10) During the global financial crisis in December of 2008, the 3-month, risk-free, pure discount (zero coupon) T-Bill briefly traded in the market at a price of S1002.56 per S1000 par value bond! What is the YTM on this T-Bill, expressed in EAR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts