Question: Please show the steps to solve the problem using a Financial Calculator thanks. 2) Scan Solutions, Inc. issued a 15 year maturity, 6% semi-annual coupon

Please show the steps to solve the problem using a Financial Calculator thanks.

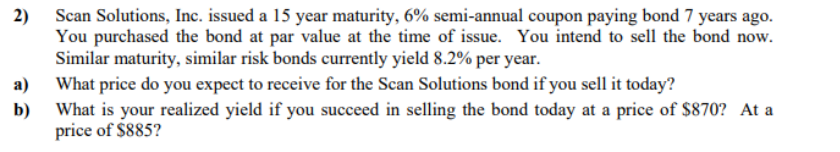

2) Scan Solutions, Inc. issued a 15 year maturity, 6% semi-annual coupon paying bond 7 years ago. You purchased the bond at par value at the time of issue. You intend to sell the bond now. Similar maturity, similar risk bonds currently yield 8.2% per year. a) What price do you expect to receive for the Scan Solutions bond if you sell it today? b) What is your realized yield if you succeed in selling the bond today at a price of $870 ? At a price of $885

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts