Question: PLEASE SHOW THE STEPS TO SOLVING QUESTION CLEARLY (Assume the following information: U.S. deposit rate for 1 year = 6% U.S. borrowing rate for 1

PLEASE SHOW THE STEPS TO SOLVING QUESTION CLEARLY

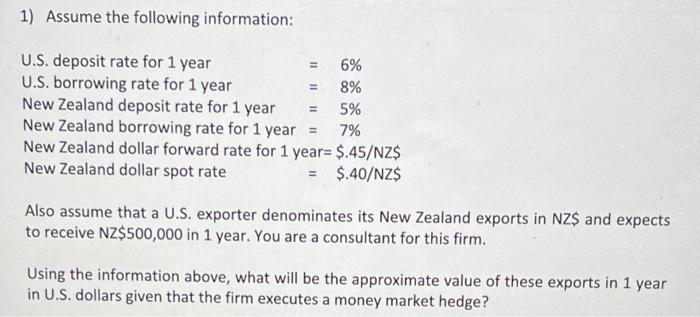

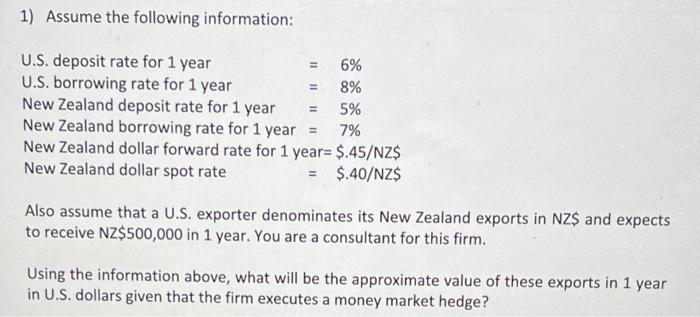

(Assume the following information:

U.S. deposit rate for 1 year

=

6%

U.S. borrowing rate for 1 year

8%

New Zealand deposit rate for 1 year

5%

New Zealand borrowing rate for 1 year

7%

New Zealand dollar forward rate for 1 year= $.45/NZ$

New Zealand dollar spot rate

$.40/NZ$

Also assume that a U.S. exporter denominates its New Zealand exports in N$ and expects

to receive N$500,000 in 1 year. You are a consultant for this firm.

Using the information above, what will be the approximate value of these exports in 1 year

in U.S. dollars given that the firm executes a money market hedge?)

1) Assume the following information: 11 11 U.S. deposit rate for 1 year 6% U.S. borrowing rate for 1 year 8% New Zealand deposit rate for 1 year 5% New Zealand borrowing rate for 1 year = 7% New Zealand dollar forward rate for 1 year= $.45/NZ$ New Zealand dollar spot rate = $.40/NZ$ Also assume that a U.S. exporter denominates its New Zealand exports in NZ$ and expects to receive NZ$500,000 in 1 year. You are a consultant for this firm. Using the information above, what will be the approximate value of these exports in 1 year in U.S. dollars given that the firm executes a money market hedge

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock