Question: please show the steps with the formals HW Score: 37. 30 of pts Score: 0 of 10 pts X P12-8 (similar to) Related to Checkpoint

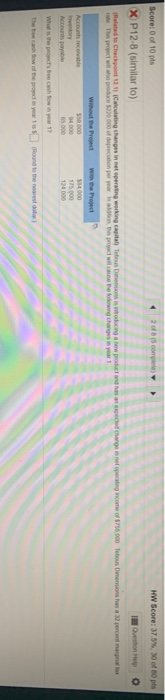

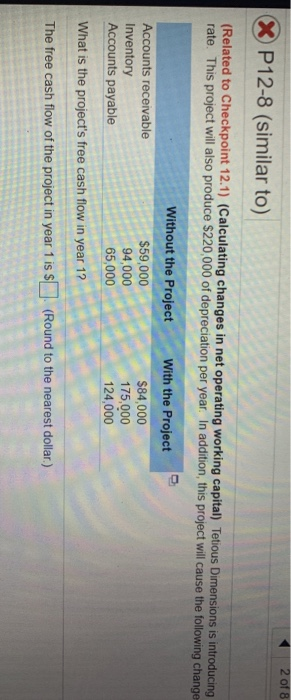

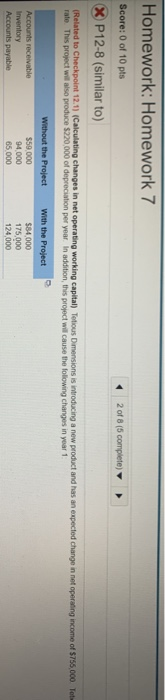

HW Score: 37. 30 of pts Score: 0 of 10 pts X P12-8 (similar to) Related to Checkpoint 121) Calculating changes in netepering working capital Tebou Dienos i roducing a new pr o ducato per pro c ha ome of 5755.000 Totious Dension has a 32 percentant W oute Project with Project $54,000 175.000 124000 2 of 8 X P12-8 (similar to) (Related to Checkpoint 12.1) (Calculating changes in net operating working capital) Tetious Dimensions is introducing rate. This project will also produce $220,000 of depreciation per year. In addition, this project will cause the following change With the Project Without the Project Accounts receivable $59,000 Inventory 94,000 Accounts payable 65,000 What is the project's free cash flow in year 1? $84,000 175,000 124,000 The free cash flow of the project in year 1 is $ (Round to the nearest dollar.) HW Score: 37.5%, 30 of 80 pts 2018 (5 complete) Question Help eating working capital Tebow Dension is introducing a new product and has an expected change in net operating income of $755,000 Totious Dimensions has a 32 percent marginal tax on the prop h e following changes in year 1 the Project Homework: Homework 7 Score: 0 of 10 pts X P12-8 (similar to) 2 of 8 (5 complete) (Related to Checkpoint 12.11 (Calculating changes in net operating working capital) Totious Dimensions is introducing a new product and has an expected change in net operating income of $755.000 Tot rate. This project will also produce $220,000 of depreciation per year. In addition, this project will cause the following changes in year 1 Without the Project Accounts receivable Inventory Accounts payable 559,000 94.000 65 000 with the Project 564.000 175,000 124,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts