Question: Please show the work and steps please answer part C in this case. Question 3 ( 18 points) Rome Commons Lessor Corp. is a manufacturer

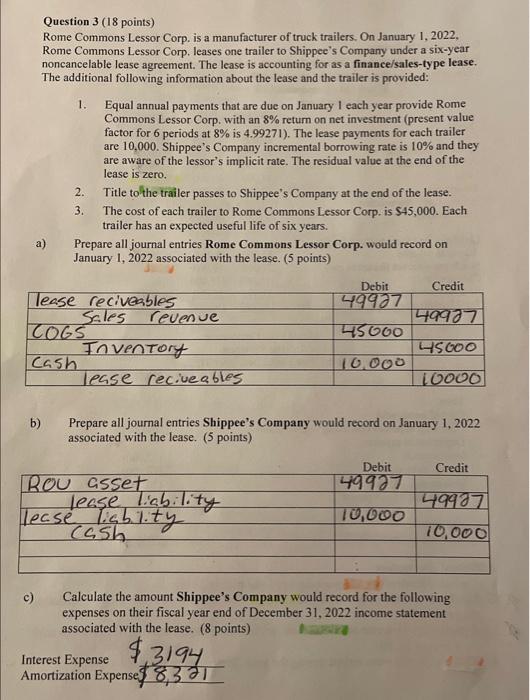

Question 3 ( 18 points) Rome Commons Lessor Corp. is a manufacturer of truck trailers. On January 1, 2022, Rome Commons Lessor Corp. leases one trailer to Shippee's Company under a six-year noncancelable lease agreement. The lease is accounting for as a finance/sales-type lease. The additional following information about the lease and the trailer is provided: 1. Equal annual payments that are due on January I each year provide Rome Commons Lessor Corp, with an 8% return on net investment (present value factor for 6 periods at 8% is 4.99271 ). The lease payments for each trailer are 10,000. Shippee's Company incremental borrowing rate is 10% and they are aware of the lessor's implicit rate. The residual value at the end of the lease is zero. 2. Title to the trailer passes to Shippee's Company at the end of the lease. 3. The cost of each trailer to Rome Commons Lessor Corp. is $45,000. Each trailer has an expected useful life of six years. a) Prepare all journal entries Rome Commons Lessor Corp. would record on January 1, 2022 associated with the lease. (5 points) b) Prepare all journal entries Shippee's Company would record on January 1, 2022 associated with the lease. (5 points) c) Calculate the amount Shippee's Company would record for the following expenses on their fiscal year end of December 31, 2022 income statement associated with the lease. ( 8 points) Question 3 ( 18 points) Rome Commons Lessor Corp. is a manufacturer of truck trailers. On January 1, 2022, Rome Commons Lessor Corp. leases one trailer to Shippee's Company under a six-year noncancelable lease agreement. The lease is accounting for as a finance/sales-type lease. The additional following information about the lease and the trailer is provided: 1. Equal annual payments that are due on January I each year provide Rome Commons Lessor Corp, with an 8% return on net investment (present value factor for 6 periods at 8% is 4.99271 ). The lease payments for each trailer are 10,000. Shippee's Company incremental borrowing rate is 10% and they are aware of the lessor's implicit rate. The residual value at the end of the lease is zero. 2. Title to the trailer passes to Shippee's Company at the end of the lease. 3. The cost of each trailer to Rome Commons Lessor Corp. is $45,000. Each trailer has an expected useful life of six years. a) Prepare all journal entries Rome Commons Lessor Corp. would record on January 1, 2022 associated with the lease. (5 points) b) Prepare all journal entries Shippee's Company would record on January 1, 2022 associated with the lease. (5 points) c) Calculate the amount Shippee's Company would record for the following expenses on their fiscal year end of December 31, 2022 income statement associated with the lease. ( 8 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts