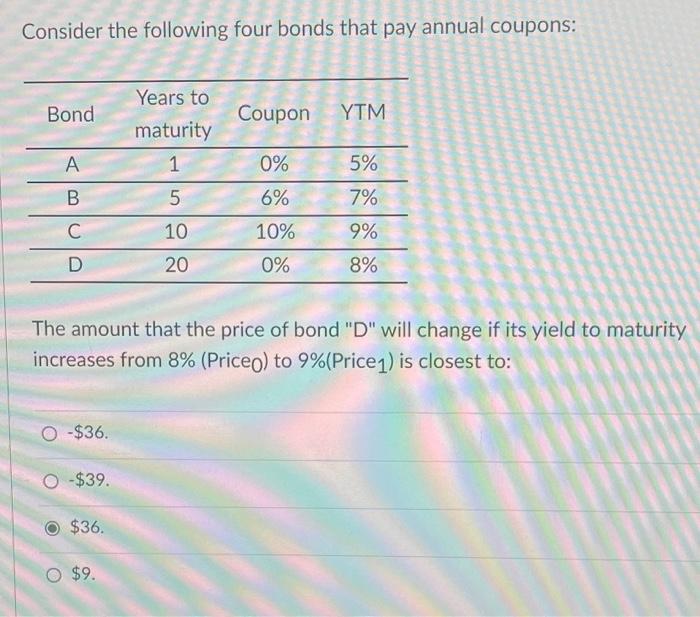

Question: please show the work Consider the following four bonds that pay annual coupons: Bond Coupon YTM Years to maturity 1 0% 5% 7% B 5

Consider the following four bonds that pay annual coupons: Bond Coupon YTM Years to maturity 1 0% 5% 7% B 5 6% 10 10% 9% D 20 0% 8% The amount that the price of bond "D" will change if its yield to maturity increases from 8% (Priceo) to 9%(Price1) is closest to: O -$36. O $39. $36. O $9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts