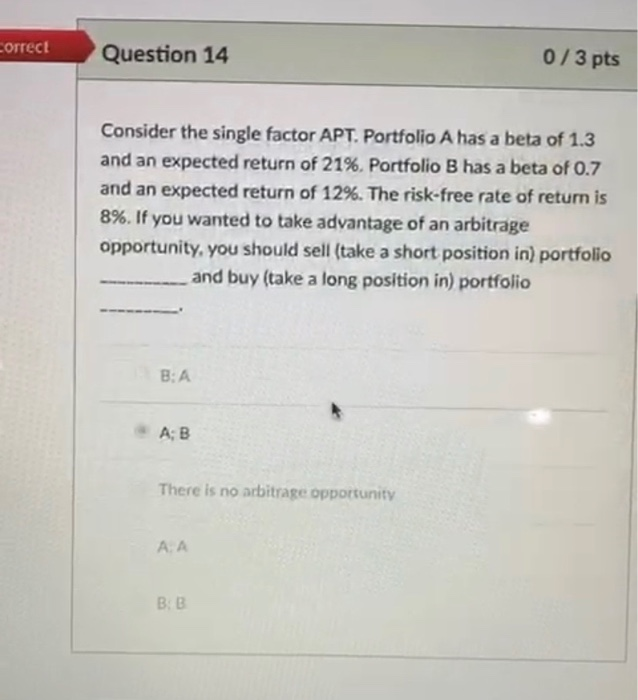

Question: please show the work for question #14 Et Question 1 0/3 pts Increasing the number of stocks in a portfolio from 10 to 50 would

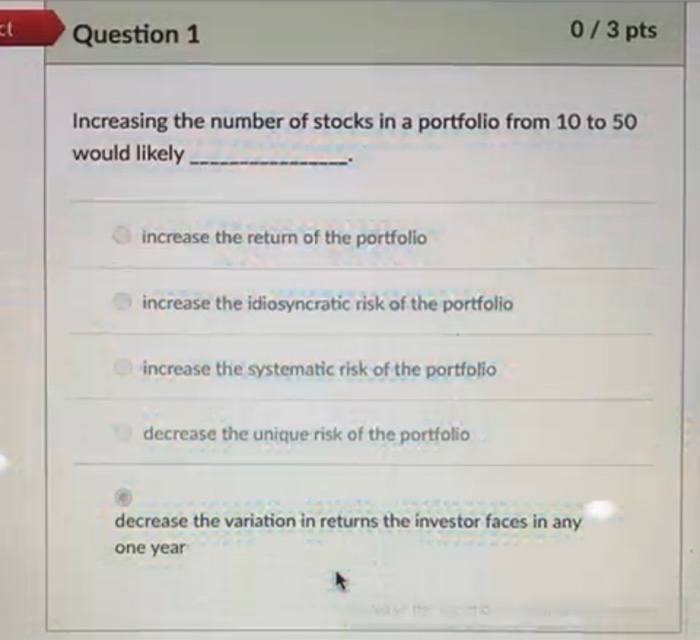

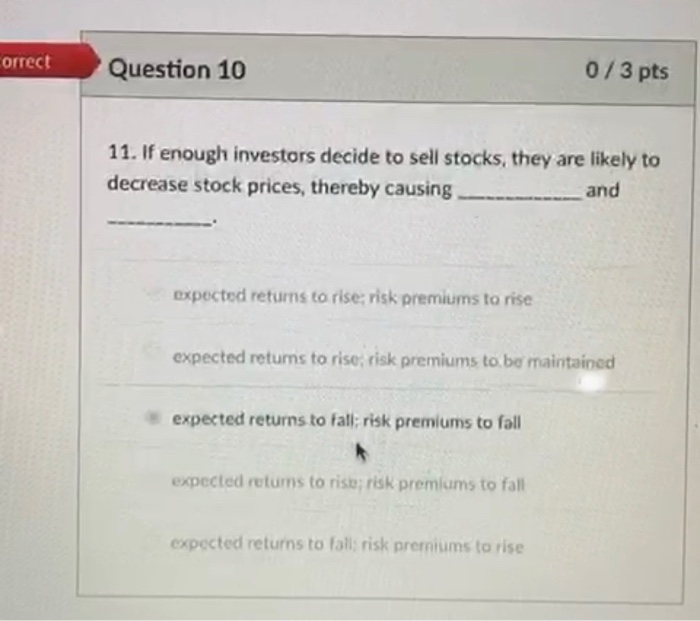

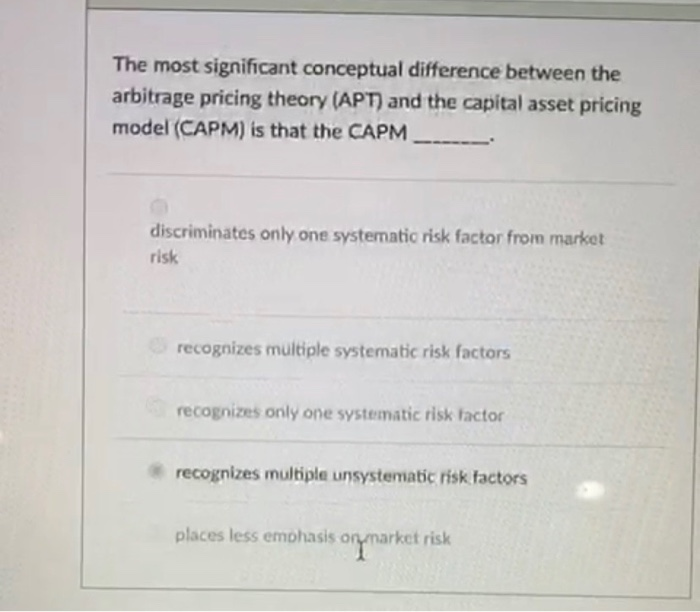

Et Question 1 0/3 pts Increasing the number of stocks in a portfolio from 10 to 50 would likely increase the return of the portfolio increase the idiosyncratic risk of the portfolio increase the systematic risk of the portfolio decrease the unique risk of the portfolio decrease the variation in returns the investor faces in any one year correct Question 10 0/3 pts 11. If enough investors decide to sell stocks, they are likely to decrease stock prices, thereby causing and expected returns to rise: risk premiums to rise expected returns to rise, risk premiums to be maintained expected returns to fall; risk premiums to fall expected returns to rise; risk premiums to fall expected returns to fall risk premiums to rise The most significant conceptual difference between the arbitrage pricing theory (APT) and the capital asset pricing model (CAPM) is that the CAPM discriminates only one systematic risk factor from market risk recognizes multiple systematic risk factors recognizes only one systematic risk factor recognizes multiple unsystematic risk factors places less emphasis or market risk correct Question 14 0/3 pts Consider the single factor APT. Portfolio A has a beta of 1.3 and an expected return of 21%. Portfolio B has a beta of 0.7 and an expected return of 12%. The risk-free rate of return is 8%. If you wanted to take advantage of an arbitrage opportunity, you should sell (take a short position in) portfolio and buy (take a long position in) portfolio BA AB There is no arbitrage opportunity AA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts