Question: please show the work Here is the option premium Score: 2 of 5 pts 10 of 10 (10 complete) HW Score: 82.75%, 41.38 of 50

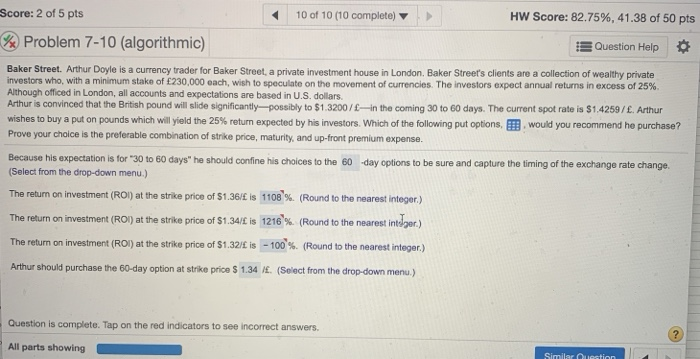

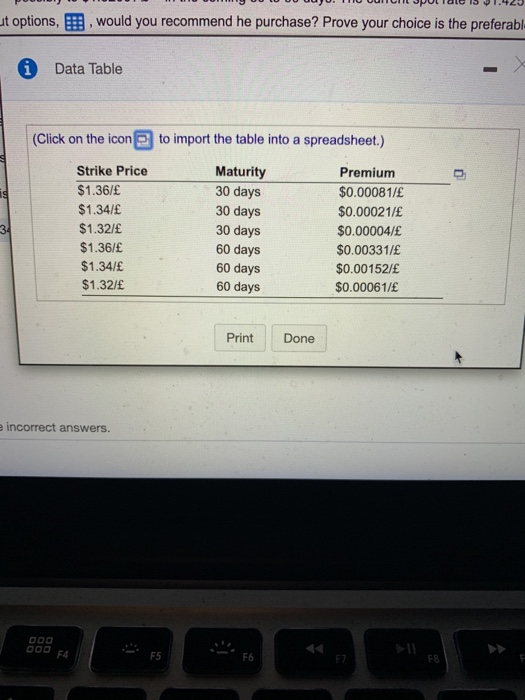

Score: 2 of 5 pts 10 of 10 (10 complete) HW Score: 82.75%, 41.38 of 50 pts We Problem 7-10 (algorithmic) Question Help Baker Street Arthur Doyle is a currency trader for Baker Street, a private investment house in London, Baker Street's clients are a collection of wealthy private investors who, with a minimum stake of 230,000 each, wish to speculate on the movement of currencies. The investors expect annual returns in excess of 25% Although offices in London, all accounts and expectations are based in U.S. dollars. Arthur is convinced that the British pound will slide significantly-possibly to $1.3200/in the coming 30 to 60 days. The current spot rate is $1.4259/. Arthur wishes to buy a put on pounds which will yield the 25% return expected by his investors. Which of the following put options, would you recommend he purchase? Prove your choice is the preferable combination of strike price, maturity, and up-front premium expense. Because his expectation is for "30 to 60 days" he should confine his choices to the 60 day options to be sure and capture the timing of the exchange rate change. (Select from the drop-down menu.) The retum on investment (ROI) at the strike price of $1.36/ is 1108%. (Round to the nearest integer) The return on investment (ROI) at the strike price of $1.34/ is 12169% (Round to the nearest inter.) The return on investment (ROI) at the strike price of $1.32/ is - 100%. (Round to the nearest integer.) Arthur should purchase the 60-day option at strike price $ 1.34 . (Select from the drop-down menu.) Question is complete. Tap on the red indicators to see incorrect answers. . All parts showing Similar Question ut options, would you recommend he purchase? Prove your choice is the preferabl i Data Table (Click on the icon to import the table into a spreadsheet.) 18 3 Strike Price $1.36/ $1.34/ $1.32/ $1.36/ $1.34/ $1.32/ Maturity 30 days 30 days 30 days 60 days 60 days 60 days Premium $0.00081/ $0.00021/ 60.00004/ $0.00331/ $0.00152/ $0.00061/ Print Done e incorrect answers. DOO ODD 54 F5 F6 F7 F8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts