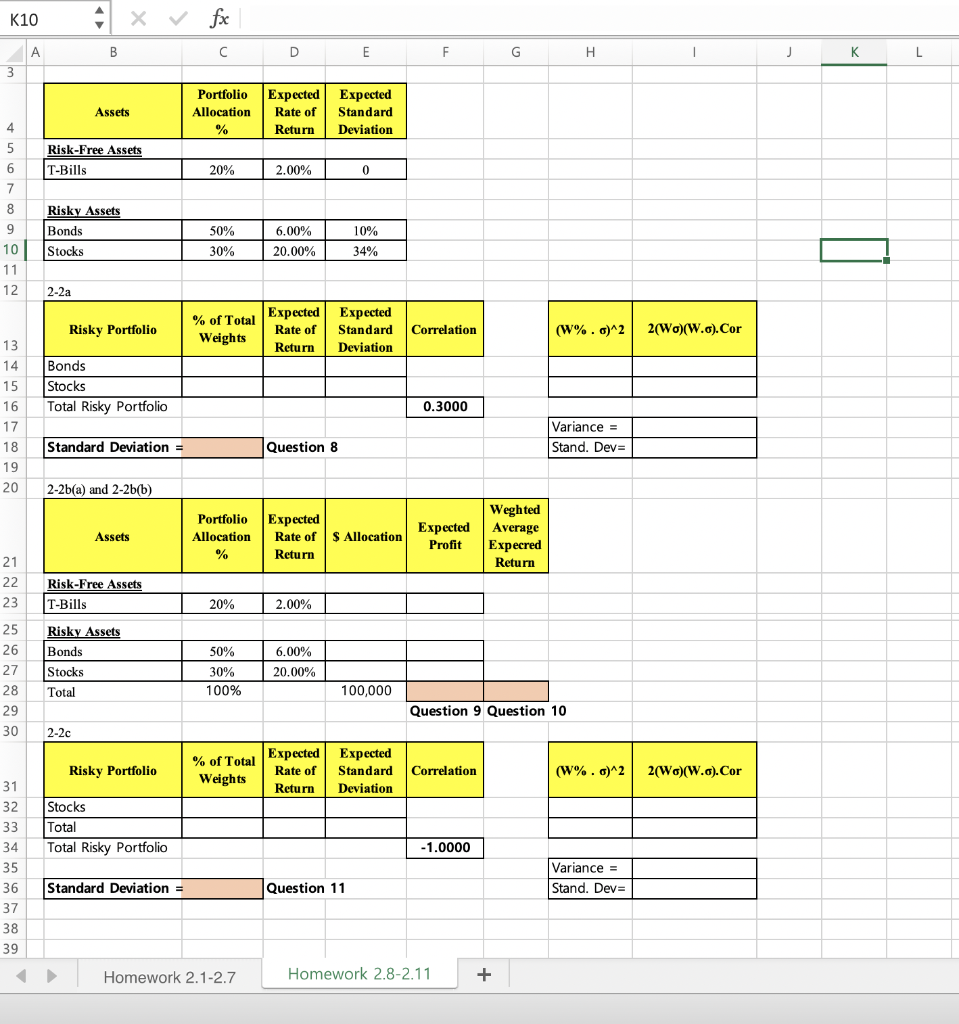

Question: Please show the work how to find the answer such as the formula in excel (STDEV(..), AVE(..) ) K10 A x fx B D E

Please show the work how to find the answer such as the formula in excel (STDEV(..), AVE(..) )

K10 A x fx B D E F G . K L A 3 Portfolio Allocation % Expected Rate of Assets Expected Standard Deviation 4 Return 5 Risk-Free Assets T-Bills 6 20% 2.00% 0 7 8 9 10 11 12 Risky Assets Bonds Stocks 6.00% 50% 30% 10% 34% 20.00% 2-2a Risky Portfolio % of Total Expected Expected Rate of Standard Return Deviation Correlation 2(Wo)(W.o).Cor (W%. 6)^2 Weights 13 14 15 16 17 18 19 20 Bonds Stocks Total Risky Portfolio 0.3000 Variance = Stand. Dev= Standard Deviation = Question 8 2-2b(a) and 2-2b(b) Assets Portfolio Allocation % Expected Rate of Return $ Allocation Expected Profit Weghted Average Expecred Return 21 22 23 Risk-Free Assets T-Bills 20% 2.00% 25 26 27 28 29 30 Risky Assets Bonds Stocks Total 50% 30% 100% 6.00% 20.00% 100,000 Question 9 Question 10 2-2c Risky Portfolio % of Total Expected Expected Rate of Standard Weights Return Deviation Correlation (W%. c)^2 2(Wo)(W..).Cor Stocks Total Total Risky Portfolio -1.0000 31 32 33 34 35 36 37 38 39 Standard Deviation = Variance = Stand. Dev= Question 11 Homework 2.1-2.7 Homework 2.8-2.11 +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts